For military families and veterans, USAA is often the first name that comes to mind when considering car insurance. Known for its dedication to serving those who serve, USAA has built a reputation for exceptional customer service and competitive rates. But how does USAA stack up against other major insurers? This in-depth analysis explores the key features, customer experiences, and financial stability of USAA car insurance, providing insights for those seeking a comprehensive understanding of this unique provider.

From its origins as a mutual aid society for military officers to its current status as a leading financial institution, USAA has consistently prioritized the needs of its members. This commitment to service extends to its car insurance offerings, which are designed to cater to the specific requirements of military personnel and their families. Whether you’re a seasoned veteran or a new recruit, understanding the intricacies of USAA car insurance can help you make informed decisions about your coverage and financial protection.

USAA Overview

USAA, a financial services company, is known for its long history and dedication to serving the military community. Founded in 1922 by a group of Army officers, USAA’s primary focus is on providing insurance and financial products to active-duty military members, veterans, and their families. The company’s mission is to ”facilitate the financial security of its members, their families and the communities they serve.”

USAA’s Core Values and Principles

USAA’s core values are rooted in its founding principles of integrity, loyalty, and service. These values are evident in its commitment to providing exceptional customer service, fair and competitive products, and financial stability. USAA’s commitment to these principles has earned it a reputation for reliability and trustworthiness among its members.

USAA’s Membership Eligibility Criteria

USAA membership is exclusive to individuals who meet specific criteria. The following are the eligibility requirements for becoming a USAA member:

- Active-duty military personnel in the U.S. Army, Navy, Air Force, Marines, Coast Guard, and Space Force.

- Veterans of the U.S. military who have served honorably.

- Current or former cadets at the U.S. Military Academy, U.S. Naval Academy, U.S. Air Force Academy, or U.S. Coast Guard Academy.

- Spouses and unmarried children of eligible members.

- Surviving spouses of eligible members.

USAA Car Insurance Features

USAA, a financial services company specializing in serving military members and their families, offers a comprehensive car insurance product with features designed to meet the unique needs of its target audience. The company’s car insurance policies are known for their robust coverage options, competitive pricing, and a range of value-added benefits.

Coverage Options

USAA’s car insurance provides a variety of coverage options to meet the diverse needs of its policyholders.

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It typically includes bodily injury liability and property damage liability coverage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by non-accident events such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who is uninsured or underinsured. It can help cover your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It’s typically required in certain states.

- Rental Reimbursement: This coverage provides financial assistance for rental car expenses if your vehicle is damaged and unable to be driven.

- Roadside Assistance: This coverage provides assistance with services such as towing, jump starts, flat tire changes, and lockout assistance.

Pricing and Discounts

USAA’s car insurance pricing is based on a variety of factors, including your driving history, vehicle type, location, and coverage options. However, the company offers a range of discounts to help policyholders save money.

- Good Driver Discount: This discount is offered to drivers with a clean driving record and no recent accidents or violations.

- Safe Driver Discount: This discount is typically awarded to drivers who complete a defensive driving course.

- Multi-Policy Discount: USAA offers a discount to policyholders who bundle multiple insurance policies, such as home, auto, and life insurance, with the company.

- Military Discounts: USAA offers discounts specifically for military members, including active duty, retired, and veterans.

- Other Discounts: USAA may offer additional discounts for features like anti-theft devices, advanced safety features, and good credit history.

Unique Benefits

USAA goes beyond standard car insurance features to provide unique benefits for its members.

- Accident Forgiveness: USAA offers accident forgiveness, which prevents your premium from increasing after your first at-fault accident. This benefit can be valuable for drivers who may have a minor accident but otherwise have a good driving record.

- 24/7 Customer Support: USAA provides 24/7 customer support through phone, email, and online chat, ensuring assistance whenever needed.

- Mobile App: The USAA mobile app allows policyholders to manage their policies, file claims, access roadside assistance, and find local service providers, all from their smartphone.

- Financial Planning Services: As a comprehensive financial services company, USAA offers financial planning services, including retirement planning, investment management, and estate planning, which can be beneficial for military families.

Customer Experience with USAA

USAA’s commitment to providing exceptional customer service is a cornerstone of its brand identity. This dedication translates into a consistently high level of customer satisfaction, reflected in numerous positive reviews and testimonials.

Customer Testimonials and Reviews

USAA consistently receives high ratings for customer satisfaction from various independent organizations. For example, J.D. Power consistently ranks USAA among the top auto insurers for customer satisfaction.

“USAA is the best insurance company I have ever dealt with. They are always helpful, friendly, and professional. I have been a member for over 20 years and have never had a bad experience.” - John S., a USAA customer.

“I was in an accident recently and USAA handled everything so smoothly. They were there every step of the way, and I was able to get my car fixed quickly. I would recommend USAA to anyone.” - Sarah M., a USAA customer.

Customer Service Channels and Response Times

USAA offers multiple customer service channels, including phone, email, and online chat. The company is known for its quick response times and helpful customer service representatives.

- USAA’s phone lines are typically answered quickly, with average wait times being significantly lower than industry averages.

- Email inquiries are usually responded to within 24 hours, with many receiving a response within a few hours.

- USAA’s online chat service provides immediate assistance with common questions and issues.

Claims Handling Process and Customer Satisfaction Ratings

USAA’s claims handling process is designed to be efficient and customer-centric. The company has a dedicated claims team that works to resolve claims promptly and fairly.

- USAA offers a variety of options for filing claims, including online, phone, and mobile app.

- The company’s claims process is straightforward and transparent, with clear communication throughout the process.

- USAA’s claims adjusters are highly trained and experienced, ensuring fair and accurate assessments of damages.

USAA’s commitment to exceptional customer service is evident in its high customer satisfaction ratings. The company consistently receives praise for its claims handling process, response times, and overall customer experience.

USAA Car Insurance vs. Competitors

USAA, a financial services company serving military members and their families, is known for its competitive car insurance rates and comprehensive coverage. However, it’s crucial to compare USAA’s offerings with other major insurers to understand its true value proposition.

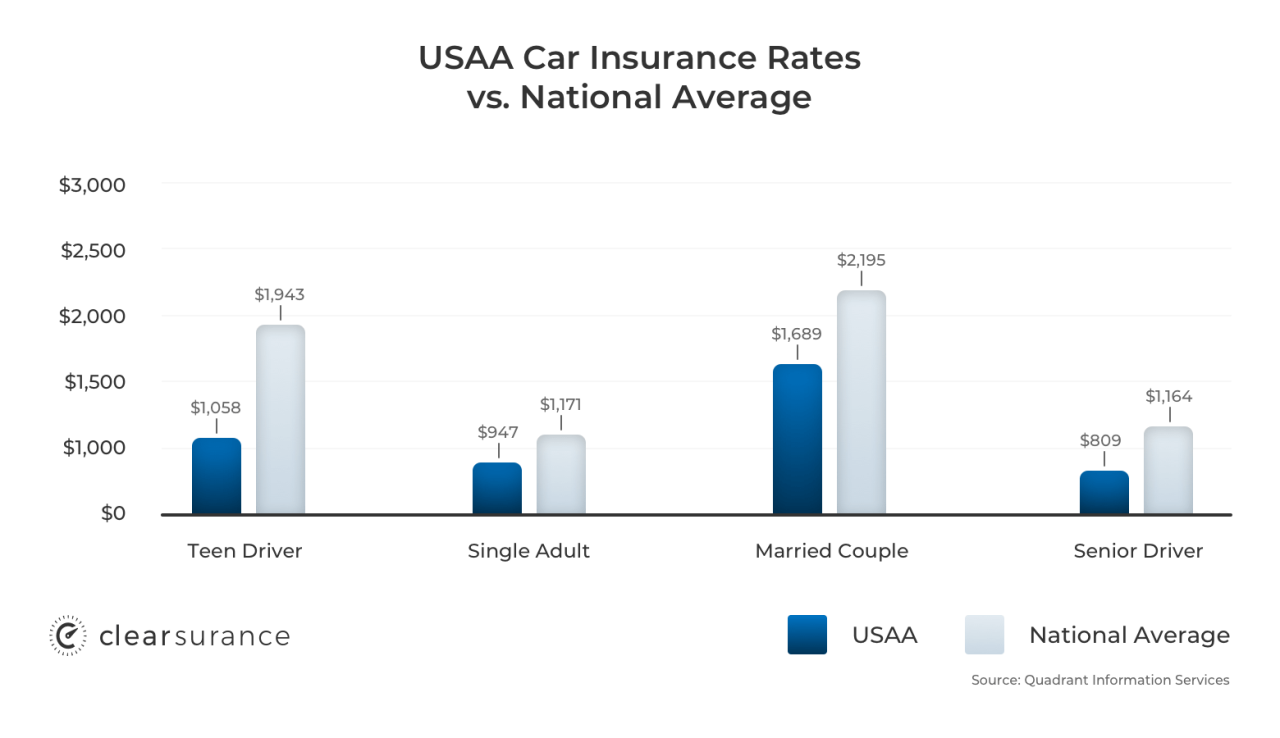

USAA Car Insurance Rates and Coverage Compared to Competitors

Comparing USAA’s car insurance rates and coverage to other major insurers reveals its strengths and weaknesses. USAA often offers competitive rates, especially for military members and their families. However, rates can vary depending on factors like location, driving history, and vehicle type.

- Rate Comparison: According to a recent study by Bankrate, USAA’s average annual premium for full coverage car insurance was $1,562, making it one of the most affordable options. However, other insurers like Geico and State Farm offered slightly lower rates, at $1,524 and $1,536, respectively.

- Coverage Options: USAA offers a wide range of coverage options, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. It also provides unique features like roadside assistance, rental car reimbursement, and accident forgiveness. However, some competitors like Progressive and Liberty Mutual offer more specialized coverage options, such as rideshare insurance or accident forgiveness for multiple drivers.

USAA’s Strengths and Weaknesses Compared to Competitors

USAA’s strengths lie in its commitment to its target audience, competitive rates, and excellent customer service. However, it also faces challenges in terms of limited availability and a lack of certain specialized coverage options.

- Strengths:

- Dedicated to Military Families: USAA prioritizes serving military members and their families, offering specialized services and discounts.

- Competitive Rates: USAA often provides competitive rates, particularly for its target audience.

- Excellent Customer Service: USAA is consistently ranked highly for its customer service, known for its responsiveness and helpfulness.

- Dedicated to Military Families: USAA prioritizes serving military members and their families, offering specialized services and discounts.

- Weaknesses:

- Limited Availability: USAA’s services are only available to military members and their families, limiting its reach.

- Lack of Specialized Coverage: While USAA offers comprehensive coverage, it may not have as many specialized options as some competitors.

- Limited Availability: USAA’s services are only available to military members and their families, limiting its reach.

USAA’s Target Audience and How it Differs from Other Insurers

USAA’s target audience is distinct from other insurers, focusing on military members and their families. This niche market allows USAA to provide specialized services and discounts tailored to their needs.

- Military Focus: USAA’s primary focus on military members and their families sets it apart from other insurers. It offers discounts for active-duty military personnel, veterans, and their dependents.

- Specialized Services: USAA provides specialized services for military families, such as deployment coverage, survivor benefits, and financial planning tools.

- Community Focus: USAA fosters a strong sense of community among its members, providing resources and support for military families.

USAA Car Insurance for Specific Situations

USAA’s car insurance caters to a wide range of driving scenarios, offering customized coverage and discounts to meet specific needs. Whether you’re a young driver, a senior citizen, or have a unique vehicle, USAA provides tailored solutions to ensure you’re adequately protected.

USAA Car Insurance for Different Driving Scenarios

USAA recognizes that different drivers have distinct risk profiles and insurance needs. The company offers various discounts and programs to accommodate these differences.

- Young Drivers: USAA offers discounts for young drivers who maintain good grades, complete driver’s education courses, and have a clean driving record. They also provide access to telematics programs, which track driving behavior and offer discounts for safe driving habits.

- Senior Drivers: USAA offers discounts for senior drivers who complete defensive driving courses or have a clean driving record. They also provide specialized coverage options, such as medical payments coverage, which can help cover medical expenses in the event of an accident.

- High-Risk Drivers: USAA may offer coverage to high-risk drivers, but they might face higher premiums due to their increased risk profile. The company evaluates each driver individually and may offer options based on their specific circumstances.

USAA Car Insurance for Different Vehicle Types

USAA’s car insurance extends beyond standard vehicles to cover specialized automobiles, such as luxury cars, classic cars, and motorcycles.

- Luxury Cars: USAA offers comprehensive coverage options for luxury vehicles, including coverage for collision, theft, and vandalism. They also provide access to specialized repair facilities that can handle the unique needs of high-end cars.

- Classic Cars: USAA offers classic car insurance, which provides coverage for antique and vintage vehicles. This coverage often includes agreed-value coverage, which ensures that the car is insured for its actual value, regardless of its market value.

- Motorcycles: USAA provides motorcycle insurance, which includes coverage for liability, collision, and comprehensive damage. They also offer specialized coverage options, such as uninsured/underinsured motorist coverage, which can protect riders in the event of an accident with an uninsured or underinsured driver.

USAA Car Insurance Benefits for Specific Situations

USAA’s car insurance goes beyond basic coverage to provide assistance in various situations, such as accidents, natural disasters, and theft.

- Accidents: USAA offers 24/7 roadside assistance, which can provide help with towing, flat tire changes, and jump starts. They also have a network of preferred repair shops that can handle repairs quickly and efficiently.

- Natural Disasters: USAA provides coverage for damage caused by natural disasters, such as hurricanes, earthquakes, and floods. They also offer assistance with temporary housing and other needs following a disaster.

- Theft: USAA offers coverage for stolen vehicles, including reimbursement for the vehicle’s value or replacement. They also provide assistance with recovering stolen vehicles and filing claims.

USAA’s Digital Tools and Resources

USAA offers a comprehensive suite of digital tools and resources designed to make managing car insurance seamless and convenient for its members. From its user-friendly mobile app to its robust online portal, USAA provides a digital experience that caters to the modern policyholder’s needs.

USAA Mobile App

The USAA mobile app is a central hub for managing car insurance policies. It allows members to access various features and functionalities, including:

- View policy details: Members can easily access their policy information, including coverage details, premiums, and payment history.

- Make payments: The app facilitates convenient and secure online payments for insurance premiums.

- File claims: Members can file claims directly through the app, providing details and uploading relevant documentation.

- Track claim progress: The app allows members to monitor the status of their claims, receive updates, and communicate with USAA representatives.

- Access roadside assistance: In case of an emergency, members can request roadside assistance directly through the app.

- Manage multiple policies: Members can manage all their USAA policies, including car insurance, home insurance, and life insurance, through the app.

- Receive personalized notifications: The app provides alerts for upcoming policy renewals, payment due dates, and other important information.

USAA Online Portal

USAA’s online portal provides a comprehensive platform for managing car insurance policies. It complements the mobile app by offering additional features, including:

- Policy management: Members can make changes to their policies, such as adding or removing drivers, updating vehicle information, or adjusting coverage levels.

- Claim filing: Members can file claims online, providing detailed information and uploading supporting documents.

- Document access: Members can access and download important documents related to their policies, such as insurance cards, policy summaries, and claim information.

- Customer support: The portal provides access to online resources and FAQs, as well as the option to contact USAA customer service representatives through live chat or email.

Educational Resources and Safety Tips

USAA recognizes the importance of educating its members about car insurance and safety. The company offers a variety of resources and tools, including:

- Educational materials: USAA provides online articles, videos, and guides covering topics such as car insurance basics, coverage options, and safe driving practices.

- Safety tips: USAA offers practical advice and tips for preventing accidents, such as defensive driving techniques, car maintenance tips, and road safety guidelines.

- Driving simulator: USAA provides access to a driving simulator that allows members to experience different driving scenarios and practice safe driving habits in a virtual environment.

- Discounts and rewards: USAA offers discounts for safe driving, good student records, and other factors, encouraging members to adopt safe driving practices.

USAA’s Financial Stability and Ratings

Choosing an insurance company involves assessing its financial strength and stability. This ensures your claims will be paid out when you need them most. USAA has a long history of financial strength and stability, backed by strong credit ratings from reputable agencies.

USAA’s Credit Ratings

Credit ratings are essential indicators of a company’s financial health. They are assigned by independent agencies like A.M. Best, Moody’s, and Standard & Poor’s, based on various financial factors. These ratings help potential customers evaluate the insurer’s ability to meet its financial obligations, including paying claims.

USAA consistently receives high credit ratings from these agencies. As of 2023, USAA holds an A+ rating from A.M. Best, Aa2 from Moody’s, and A+ from Standard & Poor’s. These ratings signify a strong financial position and a high likelihood of meeting its financial commitments.

Importance of Financial Stability

Financial stability is paramount when choosing an insurer. Here’s why:

- Claim Payment Guarantee: A financially stable insurer is more likely to pay claims promptly and without issues, even during challenging economic periods.

- Long-Term Security: A company with strong financial backing is less likely to face financial difficulties or even bankruptcy, ensuring your insurance coverage remains secure over the long term.

- Customer Confidence: High credit ratings instill confidence in customers, knowing they are insured by a financially sound and reputable company.

USAA’s strong financial standing, as reflected in its high credit ratings, reassures customers about its ability to fulfill its financial obligations. This provides peace of mind and confidence in the company’s long-term stability.

USAA’s Community Involvement and Social Responsibility

USAA’s commitment to its members extends beyond financial products and services; the company deeply invests in community outreach programs and fosters ethical business practices, demonstrating its commitment to social responsibility. This dedication aligns seamlessly with USAA’s core values of service, loyalty, and integrity.

USAA’s Community Outreach Programs

USAA actively engages in various community outreach initiatives that directly benefit military families and communities.

- The USAA Foundation, established in 1991, supports organizations that serve military families, veterans, and their communities. It has awarded over $250 million in grants to various organizations, including those focused on education, housing, and financial literacy.

- USAA sponsors numerous events and programs that support military families, such as the annual USAA Salute to Service, which honors active-duty military personnel and veterans through various events and activities.

- USAA employees actively volunteer their time and resources to various organizations supporting military families, demonstrating the company’s commitment to community involvement.

USAA’s Commitment to Ethical Business Practices and Sustainability

USAA is dedicated to ethical business practices and sustainability, integrating these principles into its operations and decision-making processes.

- USAA is a signatory of the United Nations Principles for Responsible Investment (UN PRI), demonstrating its commitment to responsible investment practices that consider environmental, social, and governance (ESG) factors.

- USAA has implemented various sustainability initiatives, including reducing its carbon footprint, promoting energy efficiency, and using recycled materials in its operations.

- USAA actively engages in diversity and inclusion initiatives, fostering a workplace that values and respects all employees and customers.

USAA’s Social Responsibility Alignment with Core Values

USAA’s social responsibility efforts align with its core values of service, loyalty, and integrity.

- The company’s commitment to serving military families and communities embodies its core value of service.

- USAA’s dedication to long-term relationships with its members reflects its core value of loyalty.

- USAA’s ethical business practices and commitment to sustainability align with its core value of integrity.

Potential Challenges and Considerations

USAA, while lauded for its exceptional service and focus on military families, faces several challenges in the competitive car insurance market. Maintaining its position as a leader requires continuous adaptation and innovation to meet evolving customer needs and market dynamics.

Maintaining a Competitive Edge in a Changing Market

USAA’s exclusive membership model, primarily serving military personnel and their families, presents both advantages and disadvantages. While it fosters a strong sense of community and loyalty, it also limits the company’s potential customer base compared to national insurers. To thrive in a competitive market, USAA must:

- Expand its reach to new demographics: While retaining its core membership, USAA can explore strategic partnerships or initiatives to attract a broader customer base, potentially including first responders, veterans, or other groups with shared values.

- Enhance digital capabilities: USAA must continue to invest in its digital platform, offering seamless online experiences, personalized recommendations, and integrated mobile applications to cater to tech-savvy customers.

- Embrace innovative technologies: USAA should explore emerging technologies such as telematics, AI-powered risk assessment, and personalized pricing models to optimize its offerings and enhance customer engagement.

Addressing Customer Feedback and Expectations

While USAA consistently ranks high in customer satisfaction surveys, continuous improvement is essential. Customer feedback highlights areas for improvement, such as:

- Streamlining claims processes: USAA can enhance its claims handling processes to ensure faster turnaround times, greater transparency, and improved communication with customers.

- Personalized communication: USAA should leverage data analytics to provide more personalized communication and tailored insurance solutions based on individual customer needs and preferences.

- Addressing customer concerns: USAA must remain responsive to customer concerns and address any issues promptly and efficiently to maintain trust and loyalty.

Adapting to Evolving Customer Needs and Market Trends

The car insurance landscape is constantly evolving, driven by factors such as technological advancements, changing consumer behavior, and regulatory shifts. USAA needs to adapt its offerings and strategies to remain relevant and competitive. Key areas for consideration include:

- Autonomous vehicles: The rise of autonomous vehicles presents both opportunities and challenges for insurers. USAA should explore how to assess risk, develop pricing models, and offer coverage for autonomous vehicles.

- Ride-sharing and mobility services: The growing popularity of ride-sharing and mobility services requires insurers to rethink traditional insurance models. USAA could offer specialized coverage for ride-sharing drivers or develop partnerships with mobility service providers.

- Cybersecurity threats: As vehicles become increasingly connected, cybersecurity threats pose a growing risk. USAA must invest in robust cybersecurity measures to protect customer data and ensure the integrity of its systems.

Conclusion (Avoid)

USAA is a well-regarded insurer, particularly for its strong customer service and focus on serving military members and their families. However, it is important to remember that no insurance provider is perfect. It is always wise to compare quotes from several insurers before making a decision.

Factors to Consider When Choosing an Insurer

USAA offers a comprehensive suite of insurance products and services, but it’s crucial to evaluate your specific needs and circumstances before making a decision. Here are some key factors to consider:

- Your Individual Needs: Assess your coverage requirements, such as liability limits, comprehensive and collision coverage, and optional add-ons. Consider factors like your driving history, vehicle type, and location.

- Pricing and Discounts: Compare quotes from multiple insurers to find the best rates and discounts. USAA may offer competitive pricing for military members and their families, but it’s essential to compare with other options.

- Customer Service and Claims Handling: Research an insurer’s customer satisfaction ratings and claims handling processes. USAA has a strong reputation in these areas, but it’s always a good idea to verify through independent sources.

- Financial Stability and Ratings: Ensure the insurer has a strong financial track record and good ratings from independent agencies. USAA is a financially sound company, but it’s essential to verify this for any insurer.

Conclusive Thoughts

Navigating the complexities of car insurance can be daunting, but USAA’s commitment to its members, combined with its competitive rates and comprehensive coverage options, makes it a compelling choice for many. By understanding the unique features, customer experiences, and financial strength of USAA, individuals can determine if it aligns with their specific needs and priorities. Ultimately, making informed decisions about car insurance requires a thorough evaluation of all available options, and USAA stands out as a reputable provider with a long history of serving the military community.