The decision to undergo breast implant surgery is deeply personal, often carrying significant financial implications. Understanding insurance coverage for this procedure is crucial, as costs can range from thousands to tens of thousands of dollars. This comprehensive guide unravels the complexities of insurance policies, medical necessity requirements, and the often-murky waters of navigating claims and appeals.

From the variations in coverage across different insurance providers to the crucial distinction between reconstructive and cosmetic procedures, this analysis provides clarity on a subject fraught with uncertainty. We’ll explore the factors influencing coverage decisions, strategies for minimizing out-of-pocket expenses, and alternative payment options when insurance falls short.

Insurance Coverage Variations

Navigating the landscape of breast implant coverage can be complex, varying significantly depending on the insurer, the specific policy, and the individual’s circumstances. While some insurers offer comprehensive coverage, others may impose strict limitations or outright exclusions. Understanding these variations is crucial for patients considering breast implant surgery.

The extent of coverage hinges on several interacting factors. These include the stated reasons for the procedure (reconstructive versus cosmetic), the patient’s pre-existing conditions, the type of implant used, and the surgeon’s credentials. Furthermore, the insurer’s internal policies and interpretations of medical necessity play a pivotal role in determining approval.

Factors Influencing Coverage Decisions

Insurance companies generally base their coverage decisions on a complex assessment of medical necessity. Reconstructive surgery following a mastectomy due to breast cancer, for example, is far more likely to be covered than purely cosmetic augmentation. Pre-existing conditions, such as autoimmune disorders, can also influence coverage, as they may increase the risk of complications. The type of implant (silicone versus saline) might also factor into the decision, though this is less common. Finally, the surgeon’s qualifications and adherence to established medical protocols are often reviewed to assess the procedure’s safety and efficacy.

Examples of Insurance Policies

Illustrative examples of coverage discrepancies are readily available. For instance, Blue Cross Blue Shield plans often demonstrate a wide range of coverage depending on the specific plan and state. Some plans may fully cover reconstructive procedures but exclude cosmetic enhancements. Conversely, Aetna may have plans that cover a portion of the cost of both reconstructive and cosmetic procedures, subject to specific criteria and pre-authorization requirements. UnitedHealthcare policies often require pre-authorization and may have tiered coverage based on the type of facility where the procedure is performed. These examples highlight the importance of carefully reviewing individual policy details.

Comparison of Coverage Across Providers

A direct comparison across major insurance providers reveals considerable disparity. A hypothetical scenario: a patient seeking breast reconstruction after a mastectomy might find full coverage under one plan, partial coverage under another, and complete exclusion under a third. This highlights the need for prospective patients to thoroughly examine their policy documents or contact their insurer directly to determine the extent of their coverage. The lack of standardized coverage across providers underscores the importance of careful pre-operative planning and budgeting. The costs associated with breast implants, including surgery, anesthesia, and post-operative care, can be substantial, even with partial insurance coverage.

Medical Necessity and Coverage

Securing insurance coverage for breast implant surgery hinges on demonstrating medical necessity to the insurer. This necessitates a rigorous process involving comprehensive documentation and adherence to specific criteria established by the insurance provider and, often, influenced by prevailing medical guidelines. The lack of clear-cut universal standards across insurance companies can lead to significant variations in coverage decisions.

Insurance companies employ a multifaceted approach to evaluate the medical necessity of breast implants. This typically involves reviewing the patient’s medical history, the specific reasons for seeking the procedure, and the proposed surgical plan. The criteria frequently include assessing whether the implants address a reconstructive need following a mastectomy or other significant breast surgery due to illness, trauma, or congenital defects. Cosmetic enhancements, even if related to breast asymmetry or other conditions, often fall outside the scope of medically necessary procedures and thus are unlikely to receive coverage. The decision also depends heavily on the physician’s documentation, supporting the medical rationale for the implants.

Criteria for Determining Medical Necessity

Insurers assess medical necessity based on established medical guidelines and the specific details of each case. These guidelines often align with those of professional medical organizations such as the American Society of Plastic Surgeons (ASPS). Key considerations include the presence of underlying medical conditions, such as breast cancer or severe breast asymmetry causing physical discomfort or psychological distress. The evaluation will thoroughly examine the patient’s history, including previous treatments, the potential benefits of the surgery, and alternative treatment options. The insurer’s medical review team will scrutinize the physician’s justification for the procedure to ensure it aligns with accepted medical practices and that less invasive treatments have been ruled out. A crucial element is the demonstrable improvement in the patient’s physical or psychological well-being resulting from the implant surgery, which must be clearly articulated in the medical documentation.

Required Documentation for Claims

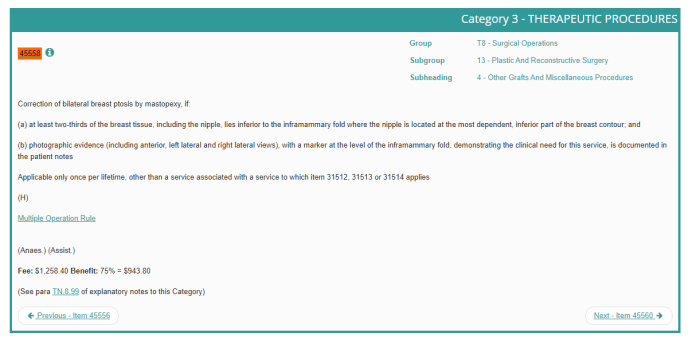

Supporting a claim for breast implant surgery requires meticulous documentation. This includes a detailed medical history outlining the patient’s condition, previous treatments, and the rationale for breast implants. The physician must provide comprehensive documentation supporting the medical necessity of the procedure, including pre-operative and post-operative plans, along with expected outcomes. Detailed photographic documentation of the patient’s breasts before and after surgery is often required. This visual record aids in demonstrating the extent of the condition and the impact of the surgery. The physician’s report should explicitly address the patient’s psychological well-being, particularly in cases where the procedure is partially driven by psychological factors. All diagnostic tests, such as mammograms or ultrasounds, should be included, and any relevant consultations with other specialists must be documented. Finally, the claim should include the complete cost breakdown of the surgery, including hospital fees, surgeon’s fees, and anesthesia costs.

Sample Pre-Authorization Letter

To: [Insurance Company Name]

From: [Physician’s Name], MD

Date: [Date]

Subject: Pre-Authorization Request for Breast Implant Surgery – Patient [Patient Name], [Patient ID Number]This letter requests pre-authorization for breast implant surgery for [Patient Name], whose policy number is [Policy Number]. [Patient Name] presents with [briefly describe medical condition necessitating implants, e.g., significant breast asymmetry causing chronic pain and psychological distress]. Detailed medical records, including diagnostic imaging and supporting documentation, are attached. These records demonstrate that conservative treatment options have been exhausted and that breast implant surgery is the medically necessary course of action to alleviate [Patient Name]’s condition and improve her quality of life. The proposed surgical plan is Artikeld in the attached surgical report. We have also included a cost estimate for the procedure. We would appreciate your prompt review of this request and notification of the pre-authorization decision. Please contact me at [Phone Number] or [Email Address] with any questions.

Sincerely,

[Physician’s Name], MD

Types of Implants and Coverage

Navigating the complexities of breast implant surgery often involves understanding the nuances of insurance coverage. While the necessity of the procedure itself is a primary factor, the specific type of implant chosen can significantly influence the likelihood and extent of insurance reimbursement. This section details the coverage variations associated with different implant types and brands.

Insurance coverage for breast implants is highly variable, depending not only on the type of implant but also on the insurer, the specific policy, and the stated medical necessity for the procedure. Factors such as pre-existing conditions, the patient’s overall health, and the surgeon’s documentation all play a role in determining coverage. While some insurers may offer broader coverage, others may impose strict limitations or require extensive justification for approval.

Implant Type and Coverage Probability

The two primary types of breast implants—saline and silicone—often present different coverage scenarios. Saline implants, filled with sterile saline solution, are generally considered less expensive and may be viewed by some insurers as a more cost-effective option, potentially leading to higher coverage probability. Silicone implants, filled with silicone gel, are often preferred for their more natural feel and appearance, but may face greater scrutiny regarding coverage due to higher costs and historical concerns, though these concerns have largely been addressed by advancements in implant technology and safety regulations.

| Implant Type | Coverage Probability | Cost Differences | Relevant Notes |

|---|---|---|---|

| Saline | Potentially higher; varies widely by insurer and policy | Generally lower initial cost than silicone implants | May be considered a more cost-effective option by some insurers; higher risk of deflation. |

| Silicone | Potentially lower; requires stronger justification of medical necessity | Generally higher initial cost than saline implants | May offer a more natural feel and appearance; subject to more stringent insurer review. |

Impact of Implant Brand on Coverage

While the type of implant (saline or silicone) is a major factor, the specific brand or manufacturer can also influence coverage decisions. Insurers may have preferred provider networks or specific contracts that impact reimbursement rates. A surgeon’s established relationship with certain implant manufacturers, or a patient’s preference for a specific brand, might not guarantee coverage. The insurer’s focus remains on the overall medical necessity and cost-effectiveness of the procedure, not brand preference.

For example, a patient might prefer a specific brand known for its longevity or reduced risk of complications. However, if that brand’s implants are significantly more expensive than others, the insurer may only approve coverage for a less costly alternative, even if the patient’s surgeon believes the preferred brand offers superior long-term outcomes. This highlights the importance of open communication between the patient, surgeon, and insurer regarding implant selection and coverage expectations.

Reconstructive vs. Cosmetic Procedures

The critical distinction between reconstructive and cosmetic breast implant procedures lies in their medical necessity and, consequently, their eligibility for insurance coverage. Reconstructive surgery aims to restore form and function following a medical event, while cosmetic surgery enhances appearance. This fundamental difference significantly impacts a patient’s ability to secure insurance reimbursement.

Insurance coverage for breast implants hinges on whether the procedure is deemed medically necessary. Cosmetic enhancements, even with significant personal impact, generally fall outside the scope of most insurance policies. Conversely, reconstructive procedures performed to address medical conditions are frequently covered, depending on the specific policy and the details of the case.

Examples of Fully Covered Reconstructive Breast Implants

Reconstructive breast implant surgery is often covered by insurance following a mastectomy due to breast cancer. Other qualifying situations include breast reconstruction after trauma resulting in significant breast tissue loss, or congenital deformities requiring surgical intervention. For example, a woman undergoing a bilateral mastectomy to treat invasive ductal carcinoma would likely have her subsequent breast reconstruction, including implants, fully covered under most comprehensive health insurance plans. Similarly, a patient who suffered severe breast trauma in a car accident leading to significant tissue damage and asymmetry could expect coverage for reconstructive surgery, provided the medical necessity is clearly documented.

Demonstrating Medical Necessity for Cosmetic Procedures

Securing insurance coverage for breast implants primarily intended for cosmetic enhancement is significantly more challenging. The burden of proof rests heavily on the patient and their physician to convincingly demonstrate a medically necessary component to the procedure. This often involves meticulously documenting any psychological distress resulting from breast asymmetry, congenital anomalies, or other conditions that may affect the patient’s mental well-being. A comprehensive psychological evaluation from a licensed professional, along with detailed medical records, can strengthen the case for coverage. It’s crucial to present a persuasive argument linking the proposed surgery to a demonstrable, diagnosable medical condition rather than simply an aesthetic preference. Success hinges on clearly establishing a nexus between the physical condition and the need for implants to address that condition, rather than purely enhancing appearance. Even with compelling documentation, approval is not guaranteed and varies widely depending on the specific insurance provider and policy.

Cost Factors and Out-of-Pocket Expenses

Breast implant surgery, while potentially life-altering, carries a significant financial burden. Understanding the various cost components and available strategies for minimizing out-of-pocket expenses is crucial for prospective patients. This section details the typical cost breakdown and offers practical approaches to navigating the financial landscape of this procedure.

Typical Cost Components of Breast Implant Surgery

The total cost of breast implant surgery is a composite of several key elements. These include surgeon fees, anesthesia costs, facility charges, and miscellaneous expenses such as prescription medications and post-operative appointments. Surgeon fees are highly variable, depending on the surgeon’s experience, location, and the complexity of the procedure. Anesthesia costs encompass the fees for the anesthesiologist and the necessary medications. Facility charges reflect the costs associated with using the surgical facility, including operating room time, nursing staff, and supplies. Finally, miscellaneous expenses can add up, particularly considering potential follow-up appointments and medication needs.

Strategies for Minimizing Out-of-Pocket Expenses

For patients with partial insurance coverage, several strategies can help mitigate out-of-pocket costs. Negotiating payment plans with the surgeon’s office can spread the financial burden over time. Exploring financing options, such as medical loans or credit cards with favorable interest rates, can provide flexibility. Carefully reviewing the insurance policy and understanding the extent of coverage, including deductibles and co-pays, is vital. Furthermore, seeking multiple quotes from different surgeons and facilities can allow for cost comparisons and the identification of more affordable options. Finally, transparency with the surgeon and administrative staff regarding financial constraints can often lead to collaborative solutions, such as adjusting the treatment plan to reduce costs.

Sample Budget Breakdown for Breast Implant Surgery

To illustrate, consider a hypothetical scenario: Let’s assume a total cost of $15,000 for breast implant surgery. This includes a surgeon’s fee of $8,000, anesthesia costs of $2,000, and facility charges of $5,000. If the patient’s insurance covers 70% of the total cost after meeting a $5,000 deductible, the following breakdown would apply:

| Cost Component | Total Cost | Insurance Coverage (70%) | Patient Responsibility |

|---|---|---|---|

| Surgeon Fees | $8,000 | $5,600 | $2,400 |

| Anesthesia | $2,000 | $1,400 | $600 |

| Facility Charges | $5,000 | $3,500 | $1,500 |

| Total | $15,000 | $10,500 | $4,500 |

Note: This is a simplified example. Actual costs and insurance coverage can vary significantly depending on individual circumstances and geographical location. It’s crucial to obtain personalized cost estimates from your surgeon and insurance provider.

Appealing Denied Claims

Insurance companies frequently deny claims for breast implant surgery, citing reasons ranging from lack of medical necessity to the procedure being deemed cosmetic rather than reconstructive. Successfully appealing a denied claim requires a thorough understanding of the insurance policy, meticulous documentation, and a persuasive argument demonstrating the medical necessity of the procedure. The appeal process can be complex and time-consuming, but persistence often yields positive results.

The process of appealing a denied claim typically involves several steps. First, carefully review the denial letter to understand the specific reasons for the denial. This letter usually Artikels the grounds for denial and the steps needed to appeal. Next, gather all relevant medical documentation, including physician’s notes, diagnostic test results, and any prior treatment records related to the condition necessitating the implants. Strong supporting documentation is crucial for a successful appeal. Finally, submit a formal appeal letter to the insurance company, clearly outlining the reasons why the denial should be overturned, referencing specific policy language and medical evidence. This letter should be concise, well-organized, and persuasive.

Appeal Letter Content and Supporting Documentation

A successful appeal letter requires a clear and concise explanation of why the initial denial was incorrect. It should explicitly address each reason given for the denial, providing counterarguments supported by medical evidence. For instance, if the denial cites the procedure as purely cosmetic, the letter must demonstrate the medical necessity, perhaps citing a history of breast asymmetry impacting the patient’s physical and psychological well-being. This might involve detailed descriptions of pain, discomfort, or functional limitations caused by the condition. Supporting documentation should include detailed medical records, physician statements affirming medical necessity, and any relevant psychological evaluations. Letters from specialists, such as plastic surgeons and psychologists, carry significant weight.

Examples of Successful Appeals

One successful appeal involved a patient who had undergone a mastectomy due to breast cancer. Her insurance initially denied coverage for reconstructive breast implants, citing a lack of documentation demonstrating the implants’ necessity for restoring her physical and emotional well-being. However, a subsequent appeal, supported by detailed medical records from her oncologist and plastic surgeon, along with a psychological evaluation documenting the significant emotional distress caused by the mastectomy, resulted in the insurance company reversing its decision. Another successful appeal involved a patient with severe breast asymmetry, which significantly impacted her physical comfort and mental health. By presenting comprehensive medical records documenting the asymmetry’s severity and the positive impact of corrective surgery on her quality of life, the patient successfully overturned the initial denial.

Gathering and Submitting Documentation

The process of gathering the necessary documentation requires careful organization and attention to detail. Begin by contacting your surgeon’s office to request copies of all relevant medical records. These records should include pre-operative evaluations, surgical reports, and post-operative notes. Obtain any imaging studies, such as mammograms or ultrasounds, related to the condition necessitating the implants. If psychological evaluations are relevant, request copies of those as well. Compile all documentation into a single, organized packet, clearly labeling each document. Submit this packet along with the appeal letter, adhering to the insurance company’s specific submission guidelines. Keep copies of all submitted materials for your records. Following up with the insurance company after submission can also be beneficial to track the progress of your appeal.

Impact of Pre-existing Conditions

Pre-existing conditions can significantly influence insurance coverage for breast implant surgery, often leading to denials or limitations on reimbursement. The impact depends on the specific condition, its severity, and the insurer’s policies. Understanding these factors is crucial for patients planning this procedure.

Pre-existing conditions that commonly affect coverage decisions include autoimmune diseases, conditions affecting blood clotting, and those that increase the risk of complications during or after surgery. These conditions can raise the likelihood of complications, potentially increasing the cost of care and leading insurers to deem the procedure too high-risk. Other factors, such as a history of significant scarring or prior breast surgeries, might also influence coverage decisions.

Autoimmune Diseases and Breast Implant Coverage

Autoimmune diseases, such as lupus or rheumatoid arthritis, can impact insurance coverage for breast implants in several ways. Insurers may be concerned about increased risks of complications, such as implant failure or infection, due to the compromised immune system. The higher risk profile might result in a denial of coverage for the procedure itself or for related post-operative care. Patients with these conditions often need to provide extensive medical documentation demonstrating their overall health and stability to improve their chances of coverage approval. This might include recent blood work, specialist consultations, and detailed medical histories. Some insurers may require a pre-authorization process, which involves a thorough review of the patient’s medical history and proposed surgical plan before approving coverage.

Blood Clotting Disorders and Surgical Risk

Individuals with blood clotting disorders, such as hemophilia or von Willebrand disease, face increased risks during and after surgery, including excessive bleeding and the formation of blood clots. These risks can make insurers hesitant to cover breast implant surgery. The potential for complications and the associated costs of managing them can lead to denials or limitations on coverage. Patients with these conditions may need to consult with a hematologist to assess their surgical risks and develop a comprehensive plan to mitigate potential complications. This plan might include pre-operative blood tests and the use of prophylactic medications to reduce the risk of bleeding and clotting. The documentation of this plan, along with the hematologist’s assessment, is often crucial in securing insurance coverage.

Addressing Coverage Limitations

Patients with pre-existing conditions seeking breast implant surgery should proactively address potential coverage limitations. This involves: thoroughly reviewing their insurance policy; documenting their medical history; obtaining pre-authorization where applicable; and consulting with both their surgeon and their insurance provider to understand coverage options and explore potential appeals processes. A comprehensive medical evaluation, detailing the patient’s overall health and the suitability of the procedure, can significantly improve the chances of obtaining insurance coverage. In some cases, seeking a second opinion from another physician may strengthen the application. Finally, exploring options for payment plans or alternative financing methods can help manage out-of-pocket costs if insurance coverage is limited or denied.

Alternative Payment Options

Securing breast implant surgery can be financially challenging even with insurance coverage. Many patients face significant out-of-pocket costs, necessitating exploration of alternative payment methods. Understanding the available options and their associated benefits and drawbacks is crucial for informed decision-making.

Medical Financing Plans

Medical financing plans offer a structured approach to paying for healthcare procedures. These plans typically involve fixed monthly payments over a predetermined period, often with interest. The interest rates and repayment terms vary significantly among providers. Choosing a plan requires careful comparison of APRs (Annual Percentage Rates) and total cost. Some plans may offer promotional periods with 0% interest for a limited time. However, it is crucial to fully understand the terms and conditions, including late payment fees and penalties, before committing.

- Pros: Allows patients to spread the cost of surgery over time, potentially making the procedure more affordable in the short term. Can offer predictable monthly payments, simplifying budgeting.

- Cons: Accumulation of interest can significantly increase the total cost of the procedure over the long term. Late payments can result in penalties and negatively impact credit scores. Thorough research is necessary to compare various financing options and find the most favorable terms.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs and FSAs are pre-tax accounts designed to help individuals pay for qualified medical expenses. HSAs are available to individuals with high-deductible health plans, while FSAs are often offered through employers. Both accounts allow for tax-advantaged savings that can be used towards breast implant surgery, reducing the overall tax burden. However, funds in FSAs typically expire at the end of the plan year, whereas HSA funds can roll over year to year.

- Pros: Reduces taxable income and lowers the overall cost of surgery. Funds can be used for a wide range of medical expenses.

- Cons: Requires proactive planning and saving. FSA funds may expire if not used within the plan year. HSA contributions are subject to annual limits.

Crowdfunding

Crowdfunding platforms allow individuals to solicit donations from friends, family, and the wider online community to cover medical expenses. Platforms like GoFundMe and YouCaring are commonly used for this purpose. While this approach can be successful in raising funds, it relies heavily on the individual’s social network and public disclosure of personal medical information.

- Pros: Potential to raise substantial funds, especially for procedures with high out-of-pocket costs. Can provide emotional support from a community of supporters.

- Cons: Relies on the generosity of others and may not always generate sufficient funds. Requires public disclosure of personal information and may not be suitable for all individuals.

Personal Loans

Personal loans from banks or credit unions can be used to finance breast implant surgery. Interest rates and repayment terms vary depending on the lender and the borrower’s creditworthiness. This option requires careful consideration of the interest rate and total repayment cost, as it can add significant expense to the procedure. It’s crucial to compare interest rates from multiple lenders to secure the most favorable terms.

- Pros: Offers flexibility in terms of repayment schedules. Can be a viable option when other funding sources are insufficient.

- Cons: High interest rates can significantly increase the total cost. A poor credit score may result in higher interest rates or loan denial.

Legal Aspects of Insurance Coverage

Navigating the legal landscape surrounding insurance coverage for breast implant surgery requires a clear understanding of patients’ rights and the potential for disputes with insurance providers. Denial of coverage, often based on interpretations of medical necessity, can lead to significant financial burdens and legal challenges for patients. This section Artikels the key legal considerations involved.

Patient Rights Regarding Insurance Coverage

Patients possess legal rights related to accessing information about their insurance policy’s coverage for breast implant procedures. These rights typically include the right to receive a clear and concise explanation of the policy’s terms and conditions regarding coverage for such surgeries, including any limitations or exclusions. Furthermore, patients have the right to appeal a denial of coverage, following the procedures Artikeld in their insurance policy and applicable state regulations. These appeals processes often involve submitting additional medical documentation to support the medical necessity of the procedure. Failure to adhere to these procedures can impact the success of an appeal.

Potential Legal Issues Arising from Denied Claims

Disputes over insurance coverage for breast implant surgery can arise from various sources, leading to potential legal action. Common issues include disagreements about whether the procedure is medically necessary, interpretations of policy language regarding pre-existing conditions, and challenges to the adequacy of the insurer’s review process. If an insurer denies coverage without providing adequate justification or following proper procedures, a patient may have grounds to file a lawsuit alleging breach of contract or bad faith. These cases often involve demonstrating that the insurer acted unreasonably or in violation of state insurance regulations.

Examples of Legal Cases Related to Breast Implant Coverage

While specific case details are often confidential and vary by jurisdiction, several legal precedents exist regarding insurance coverage for breast implant surgery. For example, cases have been brought challenging denials of coverage for reconstructive surgery following mastectomies, arguing that the insurer’s interpretation of ”medical necessity” was too narrow. Other cases have focused on the insurer’s failure to provide a fair and impartial review process, leading to successful appeals or legal action. The outcomes of such cases depend heavily on the specifics of the policy, the applicable state laws, and the evidence presented. Legal precedent in these areas is often established on a state-by-state basis, influencing the strategies employed by both patients and insurance companies.

Ending Remarks

Securing insurance coverage for breast implant surgery requires meticulous planning and a thorough understanding of your policy. This guide has illuminated the key factors influencing coverage decisions, from medical necessity documentation to the appeal process for denied claims. By understanding your rights, meticulously documenting your case, and exploring alternative payment options, you can navigate the financial complexities of this procedure with greater confidence and clarity.