Choosing a career path requires careful consideration. Two lucrative options often considered are real estate and insurance brokerage. Both involve client interaction, sales, and navigating complex regulations, yet their daily realities, required skill sets, and earning potential differ significantly. This comparison delves into the core aspects of each profession, offering insights to help aspiring professionals make informed decisions.

From the initial licensing hurdles and educational requirements to the nuances of client relationship management and long-term career progression, we’ll dissect the key distinctions between these two dynamic fields. Understanding the daily grind, compensation models, and inherent risks associated with each profession is crucial for anyone weighing their options.

Career Paths

Choosing between a career in real estate and insurance brokerage involves considering distinct career trajectories, educational requirements, and earning potentials. Both offer lucrative opportunities but demand different skill sets and professional approaches. Understanding the nuances of each path is crucial for prospective professionals.

Real Estate Agent Career Progression

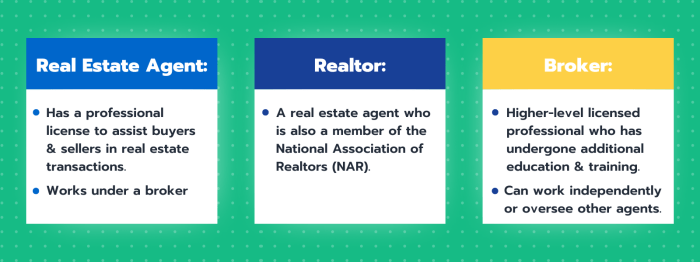

A typical career path for a real estate agent begins with securing a real estate license. This often involves completing pre-licensing education, passing a state examination, and affiliating with a brokerage firm. Early career stages focus on building a client base through networking, marketing, and providing exceptional customer service. Successful agents progressively increase their transaction volume and expand their market reach.

Experienced agents may transition into management roles within their brokerage, specializing in a niche market (e.g., luxury properties, commercial real estate), or even establish their own brokerage firms. Continuous professional development, including advanced certifications and staying abreast of market trends, is key to long-term success.

Insurance Broker Career Path

Becoming an insurance broker requires a different, yet equally structured, progression. Aspiring brokers typically begin by obtaining the necessary licenses and registrations required by their state. This usually involves completing pre-licensing coursework focusing on insurance principles, regulations, and specific lines of insurance (e.g., property, casualty, life). Passing licensing examinations is a critical step. Entry-level positions often involve working within an established brokerage firm, learning the intricacies of insurance products, client relations, and risk assessment.

Experienced brokers may specialize in a particular insurance niche, build a substantial client portfolio, or even establish their own independent brokerage. Ongoing education and professional certifications are vital for maintaining competitiveness and expanding expertise.

Educational Requirements and Licensing

Both real estate and insurance brokerage require specific licensing. Real estate agents typically need to complete a pre-licensing course, often covering topics like real estate law, contracts, and ethics. The licensing exam tests knowledge of these areas. Insurance brokers need to complete pre-licensing education, focusing on insurance principles, regulations, and specific product lines. Their licensing exams cover a broader range of insurance-related knowledge.

Continuing education is often mandatory for both professions to maintain licensure and stay updated on legal and regulatory changes.

Salary and Earning Potential

The earning potential in both fields is highly variable and depends on factors such as experience, location, specialization, and individual sales skills. Real estate agents typically earn commissions based on the value of properties sold, while insurance brokers earn commissions or fees based on the insurance policies they sell or manage. While entry-level salaries might be similar, experienced professionals in both fields can earn significantly higher incomes.

| Career Stage | Real Estate Agent Salary | Insurance Broker Salary | Notes |

|---|---|---|---|

| Entry-Level (Year 1-3) | $30,000 – $50,000 | $40,000 – $60,000 | Highly variable; dependent on transactions/sales volume. |

| Mid-Career (Year 4-10) | $70,000 – $150,000 | $60,000 – $120,000 | Significant income growth possible with established client base. |

| Experienced (Year 10+) | $150,000+ | $120,000+ | Potential for significantly higher earnings with specialization or firm ownership. |

Daily Responsibilities and Tasks

A typical day for both real estate agents and insurance brokers is highly variable, driven by client needs and market conditions. However, some core activities consistently occupy their time, revealing key differences in their daily routines and the nature of their work. While both professions require strong interpersonal skills and a results-oriented approach, the specific tasks and the pace of work differ significantly.A real estate agent’s day often involves a blend of client interaction, administrative tasks, and marketing efforts.

An insurance broker’s day, on the other hand, centers around client consultations, policy analysis, and communication with insurance carriers.

A Real Estate Agent’s Typical Workday

A typical workday for a real estate agent might begin with reviewing emails and messages from clients and colleagues. This is followed by scheduling showings for potential buyers, meeting with clients to discuss their needs and preferences, and conducting property viewings. A significant portion of the day may be dedicated to marketing properties, updating listings, and networking with other professionals in the industry.

Administrative tasks, such as preparing contracts, managing paperwork, and following up with clients, also consume considerable time. The day may conclude with updating client files and preparing for the next day’s appointments. The exact schedule is highly fluid, often dictated by client availability and market demands. For example, a busy period may involve multiple showings and negotiations, while a slower period might focus more on marketing and prospecting for new clients.

A Typical Day for an Insurance Broker

An insurance broker’s day is generally less visually dynamic than a real estate agent’s. While client interaction is crucial, it often involves in-depth conversations about insurance needs and risk assessment rather than physical property viewings. A significant portion of the day involves analyzing insurance policies, comparing quotes from different carriers, and negotiating favorable terms for clients. Much of the work is done through phone calls, emails, and meetings, with extensive documentation and record-keeping.

A substantial amount of time is spent liaising with insurance companies, processing claims, and staying updated on industry regulations and changes. This necessitates a strong understanding of insurance products and regulations, and the ability to translate complex information into clear, understandable terms for clients. For instance, a broker might spend an hour explaining the nuances of liability coverage to a client, followed by several hours comparing quotes and securing the best possible policy.

Comparison of Daily Routines

The daily routines of real estate agents and insurance brokers, while both demanding, differ significantly in their pace and focus.

- Client Interaction: Real estate agents have more face-to-face client interactions, often involving property viewings and site visits. Insurance brokers typically conduct more phone and online consultations, focusing on detailed policy discussions.

- Work Environment: Real estate agents spend a significant amount of time traveling between properties and meeting clients on-site. Insurance brokers primarily work from an office or remotely, though they may occasionally meet with clients in person.

- Transaction Focus: Real estate agents are heavily involved in the transactional aspects of property sales, managing contracts and closing deals. Insurance brokers focus on the ongoing management of insurance policies and risk mitigation.

- Marketing and Sales: Real estate agents dedicate substantial time to marketing properties and generating leads. Insurance brokers focus on building relationships with clients and insurance carriers, often through networking and referrals.

Required Skills and Attributes

Success in both real estate and insurance brokerage hinges on a potent blend of hard and soft skills, coupled with personality traits that foster client trust and drive business acumen. While the specific skill sets differ, both professions demand exceptional communication, negotiation, and problem-solving abilities to navigate complex transactions and client needs.

Essential Soft Skills for Real Estate Agents

Effective real estate agents possess a unique combination of interpersonal and communication skills. Building rapport with clients is paramount, requiring active listening, empathy, and the ability to understand their individual needs and preferences. Negotiation skills are crucial for achieving optimal outcomes in a competitive market, while strong organizational skills ensure smooth transaction management and timely communication. Furthermore, resilience and adaptability are vital for navigating the often unpredictable nature of the real estate market.

A positive and proactive attitude, coupled with a strong work ethic, helps agents consistently exceed client expectations.

Required Hard Skills for Insurance Brokers

Insurance brokerage demands a strong foundation in financial and insurance principles. A comprehensive understanding of various insurance products, risk assessment methodologies, and regulatory compliance is essential. Proficiency in sales and marketing techniques is crucial for attracting and retaining clients. Analytical skills are vital for evaluating risk profiles, comparing insurance policies, and identifying the most suitable coverage for individual clients.

Technological proficiency, particularly in insurance software and CRM systems, streamlines operational efficiency and enhances client service. Data analysis skills are increasingly important for identifying market trends and optimizing client portfolios.

Personality Traits for Real Estate and Insurance Brokers

Real estate agents thrive on extroversion, charisma, and a competitive spirit. Their ability to connect with people on a personal level is crucial for building trust and rapport. A strong sense of empathy allows them to understand clients’ emotional needs and anxieties. Insurance brokers, while needing strong communication skills, may find success with a more analytical and detail-oriented personality.

Their ability to assess risk, understand complex policies, and explain intricate details clearly is essential. Both roles, however, benefit from individuals who are highly organized, persistent, and self-motivated.

Comparison of Necessary Skills

| Skill Category | Real Estate Agent Skills | Insurance Broker Skills | Importance Level |

|---|---|---|---|

| Communication | Active listening, persuasive communication, clear written communication | Clear explanation of complex policies, effective negotiation, client education | High |

| Negotiation | Strong negotiation and compromise skills, ability to advocate for clients | Negotiating policy terms, resolving disputes, advocating for clients’ claims | High |

| Problem-Solving | Addressing client concerns, navigating complex transactions, resolving disputes | Identifying coverage gaps, assessing risk, resolving claims disputes | High |

| Market Knowledge | Deep understanding of local market trends, property values, and regulations | Knowledge of insurance products, market trends, and regulatory compliance | High |

| Organization | Managing multiple clients, scheduling appointments, managing paperwork | Managing client portfolios, tracking policies, maintaining accurate records | Medium-High |

| Technology | Proficiency in CRM software, online marketing tools, and property management systems | Proficiency in insurance software, CRM systems, and data analysis tools | Medium-High |

| Sales & Marketing | Networking, lead generation, effective marketing strategies | Lead generation, client relationship management, effective sales presentations | Medium |

| Financial Acumen | Understanding of financing options, mortgages, and real estate investment | Strong understanding of insurance principles, risk assessment, and financial analysis | Medium |

Client Interaction and Relationship Management

Effective client relationship management is paramount for success in both real estate and insurance brokerage. These professions, while distinct, share the common thread of building trust and fostering long-term partnerships to drive business growth. However, the nature of the relationship and the strategies employed differ significantly, reflecting the unique characteristics of each industry.

Real Estate Agent Client Relationship Management Strategies

Real estate agents cultivate client relationships through a multifaceted approach emphasizing personalized service and building rapport. Initial contact often involves understanding the client’s needs and preferences, whether buying or selling. This goes beyond simply listing properties; it includes understanding lifestyle aspirations, financial capabilities, and timelines. Regular communication, including market updates and property alerts, keeps clients informed and engaged.

Agents often leverage technology, employing CRM systems to track interactions and personalize communication. Building trust is crucial, requiring agents to demonstrate expertise, market knowledge, and ethical conduct. Post-transaction, maintaining contact through newsletters or social media updates fosters long-term relationships and referrals. The goal is to become a trusted advisor, guiding clients through the complex real estate process.

Insurance Broker Client Relationship Management Strategies

Insurance brokers focus on understanding clients’ risk profiles and matching them with appropriate coverage. Building trust is paramount, as clients entrust brokers with protecting their valuable assets. Regular reviews of policies are vital, ensuring coverage remains adequate as circumstances change. Brokers must stay updated on industry changes and regulations to provide informed advice. Proactive communication, such as alerts about policy renewals or potential gaps in coverage, demonstrates attentiveness and builds loyalty.

Effective risk management strategies, tailored to individual needs, are a key differentiator. Long-term relationships are nurtured through consistent, reliable service and a commitment to finding the best possible insurance solutions.

Communication Styles and Approaches

Real estate agents often employ a more enthusiastic and persuasive communication style, focusing on the emotional aspects of homeownership. Their interactions might involve showing properties, highlighting features, and emphasizing lifestyle benefits. In contrast, insurance brokers tend to use a more analytical and detail-oriented approach, focusing on risk assessment, policy specifics, and financial implications. While both professionals prioritize clear and concise communication, their emphasis differs: real estate agents often focus on building excitement and desire, while insurance brokers concentrate on conveying security and mitigating risk.

Both utilize various communication channels, including phone calls, emails, and in-person meetings, adapting their style to the client’s preferences.

Client Interaction Examples

Consider a real estate agent showing a property to a young couple. The agent might emphasize the charming neighborhood, proximity to schools, and potential for future growth, painting a picture of their future life in the home. They might even share anecdotes about the community. Conversely, an insurance broker explaining a homeowner’s insurance policy would focus on coverage limits, deductibles, and potential exclusions, explaining the policy’s terms in a clear and understandable manner.

They would highlight the financial protection offered and address any client concerns regarding specific risks. The agent’s interaction aims to create a positive emotional connection, while the broker’s aims to provide clear, factual information and build confidence in their expertise.

Marketing and Sales Strategies

Real estate agents and insurance brokers, while operating in distinct markets, share the common goal of securing clients and building lasting relationships. However, their approaches to marketing and sales differ significantly, reflecting the unique characteristics of their respective industries. Understanding these differences is crucial for professionals seeking success in either field.

Real Estate Agent Marketing Techniques

Real estate agents rely heavily on a multi-pronged marketing strategy to reach potential buyers and sellers. This often involves a blend of online and offline tactics, tailored to the local market and the specific properties being marketed. High-quality photography and videography are essential, showcasing properties in their best light through virtual tours and professional listings. Online platforms like Zillow, Realtor.com, and Trulia are crucial for maximizing exposure, while social media marketing on platforms like Instagram and Facebook allows for targeted advertising and community engagement.

Traditional methods, such as yard signs, open houses, and networking within the local community, continue to play a vital role, especially in building trust and brand recognition. Direct mail marketing, though less prevalent than in the past, can still be effective for targeting specific neighborhoods.

Insurance Broker Sales Strategies

Insurance brokers employ sales strategies focused on building trust and demonstrating the value of their services. This often involves a consultative approach, understanding the client’s specific needs and risks before recommending appropriate insurance policies. Networking is paramount, leveraging relationships with existing clients, referral sources, and other professionals in related fields. Digital marketing, including search engine optimization () and targeted online advertising, is increasingly important, allowing brokers to reach a wider audience.

Content marketing, such as informative blog posts and articles on insurance-related topics, helps establish credibility and expertise. Direct outreach through phone calls and emails, while requiring a significant time investment, can be highly effective in generating leads and building relationships. Client retention strategies, including personalized communication and proactive risk management advice, are crucial for long-term success.

Comparative Effectiveness of Marketing Approaches

The effectiveness of marketing approaches varies depending on factors such as target audience, geographic location, and economic conditions. For real estate agents, online platforms consistently yield high returns, with strong visuals and detailed property descriptions being key differentiators. However, traditional methods remain valuable for building local brand awareness and fostering personal connections. For insurance brokers, building trust and demonstrating expertise are paramount.

While online marketing plays a vital role in lead generation, the consultative sales approach and strong client relationships are often the most effective drivers of long-term success. The increasing reliance on data analytics allows both professions to refine their marketing strategies, optimizing campaigns based on performance metrics and client feedback.

Summary of Marketing and Sales Methods

- Real Estate Agents: Focus on visually appealing property presentations (high-quality photos, virtual tours), online listings (Zillow, Realtor.com), social media marketing, open houses, local networking, and targeted direct mail campaigns.

- Insurance Brokers: Emphasize building trust and demonstrating expertise through consultative selling, networking, digital marketing (, targeted ads), content marketing, direct outreach (phone calls, emails), and client retention strategies.

Legal and Regulatory Compliance

Navigating the complex legal landscapes governing real estate and insurance brokerage requires a thorough understanding of licensing, compliance, and ethical considerations. Both professions are heavily regulated to protect consumers and maintain market integrity. Failure to adhere to these regulations can result in significant penalties, including fines, suspension of licenses, and even legal action.

Real Estate Agent Legal and Regulatory Frameworks

Real estate agents operate within a framework of state and sometimes local laws. These laws dictate licensing requirements, disclosure obligations, and ethical conduct. Key areas include fair housing laws (prohibiting discrimination based on race, religion, national origin, sex, familial status, or disability), agency disclosure (clearly defining the agent’s relationship to the buyer or seller), and fiduciary duties (acting in the best interests of their client).

Specific regulations vary by jurisdiction, necessitating continuous professional development to stay abreast of changes. For instance, some states have stricter requirements for continuing education than others, impacting the ongoing compliance burden on agents. Furthermore, anti-trust laws prohibit practices like price-fixing or market allocation among competing agents.

Insurance Broker Legal and Regulatory Requirements

Insurance brokers are subject to state-level regulation, often through departments of insurance. These regulations cover licensing, continuing education, the handling of client funds (particularly premiums), and the ethical sale of insurance products. Brokers must maintain detailed records, comply with privacy laws (like HIPAA for health insurance), and adhere to specific guidelines for selling different types of insurance.

Similar to real estate, continuing education is mandatory to maintain licensure and ensure brokers stay updated on changes in regulations and product offerings. For example, a significant shift in the market towards online insurance platforms requires brokers to adapt their sales strategies and comply with evolving digital security and data privacy laws.

Comparison of Licensing and Compliance Obligations

Both real estate agents and insurance brokers require licensing, obtained through state-level examinations and background checks. Both professions also mandate continuing education to maintain licensure and stay updated on legal changes. However, the specific requirements differ significantly. Real estate licenses are generally tied to geographic location, while insurance broker licenses may offer broader coverage depending on the state and the type of insurance sold.

The nature of compliance also differs; real estate focuses heavily on disclosure and fair housing, while insurance compliance centers on client funds, product suitability, and privacy. Failure to meet these requirements can lead to license suspension or revocation in both professions.

Summary of Key Legal Aspects

| Profession | Key Legal Aspects |

|---|---|

| Real Estate Agent | State licensing, fair housing compliance, agency disclosure, fiduciary duties, antitrust laws. |

| Insurance Broker | State licensing, continuing education, handling of client funds, privacy laws (e.g., HIPAA), product suitability, adherence to specific insurance regulations. |

Technological Tools and Resources

The rapid digitization of both the real estate and insurance sectors necessitates a deep understanding of the technological tools and resources employed by professionals in these fields. Effective utilization of technology is no longer a competitive advantage; it’s a fundamental requirement for success in today’s market. This section details the key technological tools used by real estate agents and insurance brokers, highlighting the similarities and differences in their technological needs.

Essential Technological Tools for Real Estate Agents

Real estate agents leverage a suite of tools to manage listings, connect with clients, and streamline transactions. These tools are critical for maximizing efficiency and maintaining a competitive edge. Effective use of technology translates directly into increased productivity and improved client service.

- Customer Relationship Management (CRM) Software: Systems like Salesforce, HubSpot, or BoomTown allow agents to manage leads, track interactions, and nurture relationships throughout the sales cycle. These CRMs often integrate with other tools for a seamless workflow.

- Multiple Listing Service (MLS) Access: Access to the MLS is crucial for accessing property listings, sharing information with clients, and coordinating transactions. MLS platforms are often web-based and provide advanced search and filtering capabilities.

- Real Estate-Specific Software: Platforms such as kvCORE, Chime, or Realvolve offer integrated solutions combining CRM, marketing automation, and transaction management tools, streamlining various aspects of the real estate process.

- Virtual Staging and 3D Tours: Software and services allowing for virtual staging and 3D tours of properties significantly enhance online listings, providing potential buyers with an immersive experience and reducing the need for physical showings.

- Digital Marketing Tools: Real estate agents rely heavily on social media platforms (Facebook, Instagram, etc.), email marketing services, and search engine optimization () tools to reach potential clients and promote their listings.

Software and Platforms Commonly Used by Insurance Brokers

Insurance brokers utilize technology to manage client data, process applications, and compare insurance quotes across multiple carriers. Efficiency in these areas is paramount for providing timely and accurate service to clients. The use of technology also helps brokers to better analyze risk and tailor insurance solutions to individual needs.

- Agency Management Systems (AMS): These systems, such as Applied Epic or Vertafore AMS360, centralize client information, policy details, and communication records. They often include features for quoting, policy management, and commission tracking.

- Carrier Portals: Access to multiple insurance carrier portals allows brokers to submit applications, track policy status, and access essential information quickly and efficiently.

- Comparative Rating Systems: Software applications that allow brokers to quickly compare insurance quotes from multiple carriers, ensuring clients receive the best possible coverage at the most competitive price.

- CRM Software: Similar to real estate agents, insurance brokers utilize CRM systems to manage client interactions, track leads, and maintain a comprehensive database of client information.

- Compliance and Regulatory Tools: Software solutions help brokers stay abreast of constantly evolving regulatory requirements and ensure compliance with all relevant laws and regulations.

Comparison of Technological Needs and Resources

While both professions utilize CRM systems and digital marketing tools, their core technological needs differ significantly. Real estate agents heavily rely on MLS access and property visualization tools, while insurance brokers prioritize agency management systems, carrier portals, and comparative rating systems. The nature of the products and services offered shapes their respective technological requirements.

Impact of Technology on Daily Operations

Technology has revolutionized both professions. For real estate agents, it has broadened their reach, streamlined communication, and enhanced the client experience through virtual tours and online marketing. For insurance brokers, technology has automated many administrative tasks, allowing them to focus more on client relationships and providing tailored insurance solutions. In both cases, the effective use of technology is essential for maintaining a competitive edge and providing superior service.

Work-Life Balance and Job Satisfaction

The real estate and insurance brokerage industries, while both demanding and rewarding, present vastly different work-life balance scenarios and contribute to varying levels of job satisfaction among their professionals. The inherent flexibility and autonomy often associated with one profession contrast sharply with the structured, yet potentially demanding, schedules of the other. Understanding these differences is crucial for prospective entrants to both fields.

Work-Life Balance for Real Estate Agents

Real estate agents often experience highly variable work-life integration. The profession is characterized by unpredictable schedules, with evenings and weekends frequently dedicated to client meetings, open houses, and property showings. Success often hinges on availability and responsiveness, blurring the lines between professional and personal time. While some agents structure their days effectively, others find the constant “on-call” nature of the job intrusive.

The potential for significant financial rewards often motivates agents to tolerate this demanding schedule, but burnout is a recognized risk for those unable to establish healthy boundaries. For example, a highly successful agent might work 60-hour weeks during peak seasons, but this intensity is often offset by slower periods that offer more flexibility.

Work-Life Balance for Insurance Brokers

Insurance brokers typically operate within more regular business hours, although the pressure to meet sales targets and client needs can extend beyond a traditional 9-to-5 schedule. While the level of autonomy varies depending on the size and structure of the brokerage, there’s generally a greater degree of predictability compared to real estate. However, dealing with complex insurance policies, client inquiries, and regulatory compliance demands consistent attention and can lead to long hours, particularly during periods of high claims volume or new policy launches.

A broker working for a large firm might have a more structured role, while an independent broker enjoys greater flexibility but bears the responsibility of managing their time and workload independently.

Job Satisfaction in Real Estate

Job satisfaction among real estate agents is strongly correlated with financial success and a sense of accomplishment derived from successfully matching clients with their ideal properties. The independent nature of the work, coupled with the potential for high earnings, appeals to many. However, the inherent instability of income, high competition, and demanding work schedule can negatively impact job satisfaction, leading to high turnover rates.

Factors such as strong client relationships, a supportive brokerage environment, and a clear path for professional development significantly contribute to positive job satisfaction.

Job Satisfaction in Insurance Brokerage

Job satisfaction for insurance brokers is often linked to the sense of security provided by a steady income and the ability to help clients navigate complex financial risks. The intellectual challenge of understanding and explaining insurance products, combined with the satisfaction of providing crucial risk management solutions, are key contributors to positive job experiences. However, dealing with difficult clients, navigating regulatory changes, and the pressure to meet sales targets can impact job satisfaction.

A supportive team environment, opportunities for professional development, and a strong sense of purpose in protecting clients’ financial well-being are crucial factors influencing overall job satisfaction.

Financial Aspects and Compensation Models

The financial realities of both real estate agents and insurance brokers are heavily reliant on commission-based structures, though variations exist impacting income stability and potential. Understanding these models is crucial for anyone considering either career path. Significant differences exist in the predictability and level of income generated, along with the associated risks and rewards.

Real Estate Agent Compensation

Real estate agents predominantly earn income through commissions, typically a percentage of the sale price of a property. This percentage varies depending on the brokerage, the location, and the complexity of the transaction. A common structure involves a split between the agent and their brokerage, with the agent receiving a portion of the overall commission. While some brokerages offer base salaries, these are less common and often supplemented by commissions.

Income, therefore, fluctuates significantly depending on market conditions, the agent’s sales performance, and the types of properties they handle. High-value properties naturally lead to higher commissions, but also involve a longer sales cycle and more competition.

Insurance Broker Compensation

Insurance brokers’ compensation models are more diverse. Commission structures are prevalent, with brokers earning a percentage of the premiums paid by their clients. The commission rates vary based on the type of insurance, the insurer, and the broker’s relationship with the insurer. Some brokers also receive salaries, especially those employed by larger agencies. Bonus structures are common, often tied to sales targets, retention rates, or the overall profitability of the broker’s book of business.

This can lead to a more stable income stream compared to real estate, although performance still plays a critical role.

Financial Stability and Income Potential Comparison

Real estate agents face higher income volatility due to the direct correlation between sales and earnings. A slow market or a lack of successful transactions can significantly impact their income. Insurance brokers generally enjoy more stability, as their income stream is less directly tied to short-term market fluctuations. However, both professions have the potential for substantial earnings, with high-performing individuals in both fields achieving significant financial success.

The income ceiling for both is relatively high, but reaching it requires consistent effort, strong networking, and often, a considerable amount of time spent building a client base.

Compensation Methods: A Comparison

| Compensation Method | Real Estate Agent | Insurance Broker | Advantages/Disadvantages |

|---|---|---|---|

| Commission Only | Predominant model; percentage of sale price. | Common; percentage of premiums. | High earning potential, but highly variable income; risk of low or no income during slow periods. |

| Commission + Salary | Less common; usually a small base salary supplemented by commission. | More common; base salary provides stability, commission adds incentive. | Provides a safety net, but the salary component may limit overall earning potential. |

| Salary + Bonus | Rare; primarily found in large firms with structured sales targets. | Common; bonuses based on sales targets, retention, or profitability. | Offers a stable base income with the potential for significant bonuses based on performance. |

| Profit Sharing | Uncommon; may be offered by some brokerages as part of a partnership structure. | Possible in some agency structures; share of agency profits. | High potential rewards if the business is successful, but significant risk is involved. |

Career Advancement Opportunities

Both real estate and insurance brokerage offer diverse career paths, though the routes to advancement and the ultimate potential vary significantly. While both fields reward strong sales skills and client relationships, the specific skills emphasized and the hierarchical structures differ considerably. Understanding these differences is crucial for individuals considering a long-term career in either industry.

Real Estate Agent Career Advancement Paths

Real Estate agents typically progress through a relatively straightforward hierarchy. Initial success hinges on building a strong client base and closing deals. Subsequent advancement often involves increasing sales volume, expanding into specialized niches (e.g., luxury properties, commercial real estate), or moving into management roles.

Insurance Broker Career Progression

Insurance brokers, in contrast, may follow more specialized career paths. Progression can involve gaining expertise in specific insurance lines (e.g., life, health, property & casualty), managing larger accounts, achieving higher-level certifications (such as Chartered Insurance Professional designations), or moving into underwriting or risk management roles. Some brokers may eventually open their own agencies.

Comparison of Long-Term Career Prospects

Long-term prospects differ based on individual ambition and skill set. High-performing real estate agents can achieve significant financial success through commission-based income, potentially building substantial personal wealth. However, income is directly tied to market conditions and individual sales performance. Insurance brokers, while also reliant on sales, often have more stable income streams through recurring commissions and may find greater opportunities for career diversification within the insurance industry itself.

Hierarchical Representation of Career Paths

A simplified hierarchical structure can illustrate potential career progression in both fields:Real Estate: Level 1: Real Estate Agent (entry-level) Level 2: Senior Real Estate Agent (increased sales volume, specialized niche) Level 3: Team Lead/Manager (supervising other agents) Level 4: Broker/Owner (owning and managing a real estate agency)Insurance Brokerage: Level 1: Insurance Broker (entry-level) Level 2: Senior Insurance Broker (specialized expertise, larger accounts) Level 3: Account Manager/Team Lead (managing multiple accounts/brokers) Level 4: Agency Manager/Principal (owning and managing an insurance brokerage) Level 5: Underwriter/Risk Manager (moving into insurance company roles)It’s important to note that these are simplified representations.

Individual career paths may deviate significantly based on individual performance, market conditions, and personal goals. For example, a highly successful real estate agent might transition into property development, while a specialized insurance broker could move into a consulting role leveraging their expertise.

Risk and Reward Considerations

Both real estate agents and insurance brokers operate in dynamic markets characterized by significant financial potential, but also considerable risk. The level and nature of risk, however, differ substantially between the two professions, influencing the overall reward structure and requiring distinct risk mitigation strategies.

Inherent Risks for Real Estate Agents

The real estate market’s inherent volatility presents a primary risk for agents. Market downturns, shifts in interest rates, and economic recession can dramatically impact transaction volume and commission earnings. Furthermore, agents often face significant financial outlays upfront for marketing, training, and technology, without a guaranteed return. Dependence on a fluctuating commission structure, rather than a fixed salary, contributes to income instability.

The competitive nature of the industry necessitates constant self-promotion and networking, adding pressure and demanding considerable time investment. Finally, legal and ethical liabilities, such as misrepresentation or failure to disclose material facts, pose significant risks.

Potential Risks for Insurance Brokers

Insurance brokers face risks related to market competition, client retention, and regulatory compliance. The highly competitive insurance brokerage landscape requires constant adaptation to market changes and new technologies. Failure to secure and retain clients can lead to unstable income streams. Maintaining compliance with complex regulations and licensing requirements is crucial; non-compliance can result in hefty fines or even license revocation.

Providing accurate and comprehensive advice is paramount; errors or omissions in policy recommendations can lead to significant financial and reputational damage. Furthermore, the broker’s liability for errors and omissions is a continuous concern. Changes in insurance market conditions, such as increased premiums or reduced coverage availability, can also impact the broker’s ability to serve clients effectively.

Comparative Risk and Reward Analysis

While both professions offer substantial earning potential, the real estate agent’s income is more directly tied to market conditions and individual transaction success. This translates to higher risk and potentially higher reward compared to an insurance broker whose income is generally more stable but potentially capped by commission structures. A successful real estate agent in a booming market can earn significantly more than a similarly successful insurance broker, but conversely, they may experience far greater income fluctuations during economic downturns.

Insurance brokers, while facing fewer dramatic income swings, are still vulnerable to competition and regulatory changes.

Risk Mitigation Strategies

For real estate agents, diversification of client base, strong market knowledge, and effective marketing strategies are crucial for mitigating risk. Building a robust professional network and investing in continuous professional development can enhance competitiveness and adaptability. For insurance brokers, meticulous record-keeping, compliance training, and strong client relationships are key. Developing expertise in niche insurance markets and leveraging technology for efficient operations can improve competitiveness and client retention.

Maintaining professional indemnity insurance is also a critical step in protecting against liability claims.

Epilogue

Ultimately, the choice between a career as a real estate agent and an insurance broker hinges on individual strengths, preferences, and risk tolerance. While both offer rewarding financial potential and the satisfaction of building strong client relationships, the daily tasks, required skills, and long-term career trajectories differ substantially. This detailed comparison should provide the clarity needed to make an informed and confident career choice.