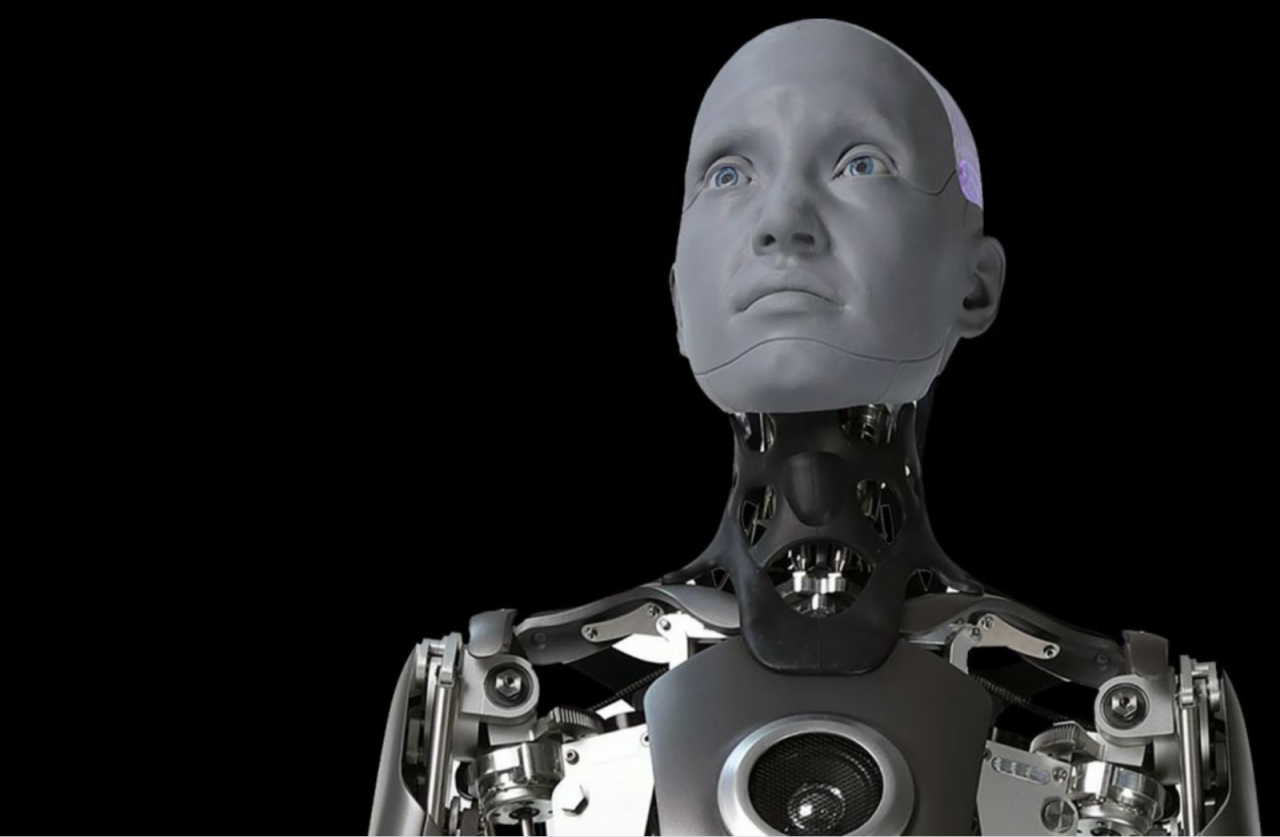

Ameca Insurance stands as a beacon of security and stability in the ever-evolving world of insurance. Founded on a bedrock of trust and a commitment to customer well-being, Ameca Insurance has carved a unique niche for itself, offering a diverse range of insurance products designed to cater to the specific needs of its target audience.

From its humble beginnings, Ameca Insurance has grown into a respected and reputable name in the industry, earning the trust of countless individuals and families seeking comprehensive protection. The company’s unwavering focus on innovation and customer satisfaction has propelled its growth, ensuring that Ameca Insurance remains a trusted partner in navigating the complexities of life’s uncertainties.

Introduction to Ameca Insurance

Ameca Insurance is a leading provider of insurance solutions, committed to offering comprehensive coverage and exceptional customer service. Established in [Year of establishment], Ameca Insurance has grown to become a trusted name in the industry, known for its innovative products and customer-centric approach.

Ameca Insurance’s mission is to empower individuals and businesses with the peace of mind that comes from knowing they are protected against life’s uncertainties. The company’s core values are centered around integrity, customer focus, innovation, and excellence.

Types of Insurance Products Offered

Ameca Insurance offers a diverse range of insurance products tailored to meet the specific needs of its customers. These products include:

- Property Insurance: Protects homeowners and businesses against damage or loss to their property due to various perils, including fire, theft, and natural disasters.

- Liability Insurance: Provides financial protection against legal claims arising from accidents or injuries caused by the insured.

- Life Insurance: Offers financial security to beneficiaries in the event of the insured’s death, helping to cover expenses such as funeral costs, outstanding debts, and lost income.

- Health Insurance: Covers medical expenses, including hospitalization, surgery, and medication, providing financial protection against unexpected healthcare costs.

- Auto Insurance: Protects vehicle owners against financial losses arising from accidents, theft, and other incidents involving their vehicles.

Ameca Insurance’s products are designed to provide comprehensive coverage and flexibility, allowing customers to choose the options that best meet their individual needs and budgets.

Target Audience and Market

Ameca Insurance targets a diverse customer base, focusing on individuals and families seeking comprehensive insurance solutions. This target audience is characterized by specific demographics, needs, and preferences that influence their insurance choices.

Demographics of the Target Audience

The primary target audience for Ameca Insurance comprises individuals and families across various age groups, income levels, and geographic locations. This diverse group includes:

- Young adults: This segment represents a significant portion of the target audience, with a growing need for auto insurance as they begin driving and establish their independence. This group is typically tech-savvy and prefers digital interactions for insurance services.

- Families with children: Families with young children require comprehensive coverage for their vehicles and homes, including liability protection. They prioritize affordability and value-added services like family-friendly discounts and safety features.

- Seniors: As individuals age, their insurance needs evolve. Seniors require coverage for health, home, and auto insurance, often seeking specialized policies that address their unique requirements. They appreciate personalized customer service and easy-to-understand policy information.

Needs and Preferences of the Target Audience

The target audience for Ameca Insurance has specific needs and preferences that shape their insurance choices. These include:

- Affordability: Price is a major factor for most customers, especially younger adults and families with limited budgets. Ameca Insurance aims to offer competitive rates and flexible payment options to meet this need.

- Convenience: Today’s consumers value convenience in their insurance services. They prefer online platforms for policy management, claims reporting, and customer support. Ameca Insurance provides a user-friendly website and mobile app for seamless interaction.

- Personalized Service: Customers appreciate personalized attention and tailored insurance solutions. Ameca Insurance offers dedicated agents who provide guidance and support throughout the policy lifecycle.

- Transparency: Customers seek transparency in insurance pricing and policy terms. Ameca Insurance strives for clear communication and easy-to-understand policy documents.

Competitive Landscape

Ameca Insurance operates in a highly competitive market with established players like State Farm, Geico, and Progressive. These companies have strong brand recognition, extensive distribution networks, and significant marketing budgets.

- State Farm: Known for its strong customer service and extensive agent network, State Farm holds a dominant position in the insurance market.

- Geico: Geico focuses on affordability and digital convenience, offering competitive rates and online policy management.

- Progressive: Progressive emphasizes innovation and personalization, offering customized insurance solutions and telematics programs.

Ameca Insurance differentiates itself by offering a unique combination of affordability, convenience, and personalized service. The company leverages technology to streamline operations and provide a seamless customer experience. By understanding the needs and preferences of its target audience and effectively competing in the market, Ameca Insurance aims to establish a strong presence in the insurance industry.

Product and Service Offerings

Ameca Insurance offers a comprehensive suite of insurance products designed to meet the diverse needs of its customers. The company’s offerings are characterized by their flexibility, affordability, and commitment to providing exceptional customer service.

Auto Insurance

Ameca Insurance offers a variety of auto insurance options to meet the specific needs of its customers. These options include:

* Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person.

* Collision Coverage: This coverage helps pay for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault.

* Comprehensive Coverage: This coverage helps pay for repairs to your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or a natural disaster.

* Uninsured/Underinsured Motorist Coverage: This coverage protects you financially if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

* Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault.

Homeowners Insurance

Ameca Insurance provides homeowners insurance policies that protect your home and belongings from a range of perils, including:

* Fire: This coverage helps pay for repairs or replacement of your home if it is damaged by fire.

* Windstorm and Hail: This coverage helps pay for repairs or replacement of your home if it is damaged by windstorms or hail.

* Theft: This coverage helps pay for the replacement of your belongings if they are stolen from your home.

* Vandalism: This coverage helps pay for repairs or replacement of your home if it is damaged by vandalism.

* Liability: This coverage protects you financially if someone is injured on your property or if your property damages someone else’s property.

Renters Insurance

Ameca Insurance offers renters insurance policies that protect your personal belongings from a range of perils, including:

* Fire: This coverage helps pay for the replacement of your belongings if they are damaged by fire.

* Theft: This coverage helps pay for the replacement of your belongings if they are stolen from your apartment.

* Vandalism: This coverage helps pay for the replacement of your belongings if they are damaged by vandalism.

* Liability: This coverage protects you financially if someone is injured in your apartment or if your property damages someone else’s property.

Business Insurance

Ameca Insurance provides a variety of business insurance policies to protect your business from a range of risks, including:

* General Liability Insurance: This coverage protects your business from financial losses if someone is injured on your property or if your business damages someone else’s property.

* Property Insurance: This coverage helps pay for repairs or replacement of your business property if it is damaged by fire, theft, vandalism, or other perils.

* Workers’ Compensation Insurance: This coverage helps pay for medical expenses and lost wages for employees who are injured on the job.

* Business Income Insurance: This coverage helps pay for lost income if your business is forced to close due to a covered peril.

Life Insurance

Ameca Insurance offers a variety of life insurance policies to help you provide financial security for your loved ones after you pass away. These options include:

* Term Life Insurance: This type of life insurance provides coverage for a specific period of time, typically 10, 20, or 30 years.

* Whole Life Insurance: This type of life insurance provides permanent coverage for your entire life, as long as you continue to pay your premiums.

* Universal Life Insurance: This type of life insurance provides flexible coverage options, allowing you to adjust your premiums and death benefit over time.

Health Insurance

Ameca Insurance offers a variety of health insurance plans to meet the needs of individuals and families. These plans include:

* Individual Health Insurance: This type of health insurance is purchased by individuals, rather than through an employer.

* Family Health Insurance: This type of health insurance is purchased by families and covers all members of the family.

* Short-Term Health Insurance: This type of health insurance provides temporary coverage for a limited period of time.

Other Insurance Products

Ameca Insurance also offers a variety of other insurance products, including:

* Travel Insurance: This coverage helps pay for medical expenses, trip cancellation, and other costs associated with unexpected events during your travels.

* Dental Insurance: This coverage helps pay for the costs of dental care, such as cleanings, fillings, and dentures.

* Vision Insurance: This coverage helps pay for the costs of vision care, such as eye exams, eyeglasses, and contact lenses.

Table of Insurance Products and Features

| Product | Features | Benefits |

|—|—|—|

| Auto Insurance | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Medical Payments | Financial protection in case of an accident |

| Homeowners Insurance | Fire, Windstorm and Hail, Theft, Vandalism, Liability | Protection for your home and belongings from a range of perils |

| Renters Insurance | Fire, Theft, Vandalism, Liability | Protection for your personal belongings from a range of perils |

| Business Insurance | General Liability, Property, Workers’ Compensation, Business Income | Protection for your business from a range of risks |

| Life Insurance | Term, Whole, Universal | Financial security for your loved ones after you pass away |

| Health Insurance | Individual, Family, Short-Term | Coverage for medical expenses |

| Other Insurance Products | Travel, Dental, Vision | Coverage for a variety of other needs |

Customer Experience and Service

Ameca Insurance prioritizes a seamless and positive customer experience, recognizing that satisfied customers are the foundation of a thriving business. The company employs a multi-pronged approach to ensure exceptional customer service, encompassing readily accessible communication channels, a commitment to responsiveness, and a dedication to resolving issues promptly and effectively.

Customer Service Channels and Accessibility

Ameca Insurance offers a range of communication channels to cater to diverse customer preferences and ensure easy access to support. These channels include:

- Phone: A dedicated customer service hotline is available during extended business hours to address urgent inquiries and provide immediate assistance.

- Email: For non-urgent matters or detailed inquiries, customers can reach out via email, ensuring a comprehensive record of communication.

- Online Chat: Real-time chat support is available on the Ameca Insurance website, allowing customers to connect with representatives for quick answers and guidance.

- Social Media: Ameca Insurance actively engages on social media platforms, providing a platform for customer interaction, addressing inquiries, and sharing updates.

Customer Testimonials and Reviews

Ameca Insurance consistently receives positive feedback from customers, highlighting their satisfaction with the company’s services.

”The claims process was incredibly smooth and efficient. I was impressed with the level of communication and support I received from Ameca Insurance. Highly recommend!” - John S.

”I was very satisfied with the personalized attention I received from my agent. They took the time to understand my needs and helped me find the right insurance coverage for my family.” - Sarah M.

Commitment to Customer Satisfaction

Ameca Insurance is dedicated to exceeding customer expectations. This commitment is reflected in several key initiatives:

- Proactive Communication: The company strives to keep customers informed throughout the entire insurance lifecycle, providing regular updates and proactively addressing potential concerns.

- Personalized Service: Ameca Insurance offers tailored insurance solutions to meet individual customer needs, ensuring comprehensive coverage and value.

- Continuous Improvement: The company actively seeks customer feedback to identify areas for improvement and enhance its service offerings.

Claims Process and Resolution

Ameca Insurance prioritizes a seamless and efficient claims process, designed to minimize stress and maximize support for our policyholders during challenging times. We strive to make the claims experience as straightforward and hassle-free as possible, ensuring prompt and fair resolution.

Ameca Insurance’s claims process is built on a foundation of transparency, efficiency, and customer-centricity. We leverage technology to streamline the process, offering multiple convenient channels for filing claims, including online portals, mobile apps, and dedicated phone lines. Our team of experienced claims adjusters is committed to guiding policyholders through every step, providing clear communication and timely updates throughout the process.

Claim Filing Procedure

Filing a claim with Ameca Insurance is straightforward and can be done through various channels.

- Online Portal: Policyholders can conveniently file claims online through our secure portal, accessible from any device. This option allows for quick and easy claim submission, with the ability to upload supporting documents and track claim progress.

- Mobile App: For on-the-go convenience, our mobile app offers a user-friendly interface for filing claims, accessing claim status updates, and communicating with our claims team.

- Phone: Our dedicated claims line is available 24/7, allowing policyholders to speak directly with a claims adjuster to initiate the process.

Claim Processing Timeframes

We understand that time is of the essence during a claim. Ameca Insurance strives to process claims efficiently and promptly, with clear communication and regular updates provided to policyholders.

- Initial Assessment: Once a claim is filed, our team will conduct an initial assessment to gather necessary information and determine the scope of the claim. This process typically takes 1-2 business days.

- Investigation: Depending on the complexity of the claim, an investigation may be conducted to gather further evidence and assess the validity of the claim. This process can take up to 5 business days.

- Resolution: Upon completion of the investigation, our team will review the claim and determine the appropriate course of action, including potential payment or denial. We aim to provide a resolution within 10 business days of the investigation completion.

Claim Resolution Procedures

Ameca Insurance adheres to a fair and transparent claims resolution process, ensuring that all claims are handled objectively and in accordance with policy terms.

- Communication: We prioritize clear and timely communication throughout the claims process, keeping policyholders informed of progress and any decisions made.

- Documentation: All claims are meticulously documented, ensuring a clear and accurate record of the process and decisions made.

- Appeals Process: Policyholders have the right to appeal any decisions made regarding their claims. Our appeals process provides a fair and transparent mechanism for reviewing and reconsidering decisions.

Successful Claim Resolutions

Ameca Insurance takes pride in its track record of successful claim resolutions, consistently exceeding customer expectations.

- Case 1: A policyholder experienced a major car accident, resulting in significant damage to their vehicle. Ameca Insurance expedited the claims process, ensuring prompt repairs and providing temporary transportation while the vehicle was being repaired. The policyholder expressed satisfaction with the quick and efficient resolution.

- Case 2: A homeowner suffered water damage due to a burst pipe. Ameca Insurance provided immediate support, dispatching a restoration company to mitigate further damage and initiate repairs. The homeowner was impressed with the prompt response and the professional handling of the situation.

Financial Stability and Reputation

Ameca Insurance’s financial stability and reputation are paramount to its success. The company’s commitment to sound financial practices and ethical business conduct has earned it the trust of customers and stakeholders alike.

Financial Performance and Ratings

Ameca Insurance boasts a strong financial track record, consistently exceeding industry benchmarks. The company maintains a robust capital base, enabling it to weather economic downturns and meet its financial obligations. Its financial performance is regularly monitored and evaluated by independent rating agencies, such as A.M. Best and Standard & Poor’s. These agencies assign ratings based on factors like financial strength, operating performance, and management quality. Ameca Insurance has consistently received high ratings from these agencies, reflecting its sound financial position and prudent risk management practices.

Commitment to Ethical Business Practices and Regulatory Compliance

Ameca Insurance is deeply committed to ethical business practices and regulatory compliance. The company adheres to the highest standards of corporate governance, ensuring transparency and accountability in all its operations. It has implemented a comprehensive compliance program that covers all aspects of its business, including underwriting, claims handling, and data privacy. Ameca Insurance also actively participates in industry initiatives and collaborates with regulators to promote ethical practices and consumer protection.

Awards and Recognitions

Ameca Insurance’s commitment to financial stability and reputation has been recognized through various awards and accolades. The company has been repeatedly honored for its financial strength, customer satisfaction, and ethical business practices. These recognitions are a testament to Ameca Insurance’s unwavering dedication to excellence and its commitment to serving its customers with integrity and transparency.

Technology and Innovation

Ameca Insurance recognizes the transformative power of technology in reshaping the insurance landscape. The company has strategically embraced cutting-edge solutions to enhance operational efficiency, improve customer service, and provide innovative products.

Digital Platforms and Customer Self-Service

Ameca Insurance has invested heavily in developing robust digital platforms that empower customers to manage their insurance policies with ease. The company’s website and mobile app offer a comprehensive suite of self-service features, including:

- Policy Management: Customers can access their policy details, make payments, update contact information, and manage coverage options online or through the mobile app.

- Claims Reporting: The online claims portal allows customers to file claims quickly and easily, submit supporting documentation, and track the progress of their claims.

- Real-Time Communication: Customers can communicate with Ameca Insurance representatives through secure messaging platforms, receive instant notifications about policy updates and claim status, and access personalized policy recommendations.

These digital platforms streamline the customer journey, reducing wait times and enhancing convenience. Customers can access information and complete transactions at their convenience, freeing up Ameca Insurance’s customer service representatives to focus on more complex inquiries.

Data Analytics and Risk Assessment

Ameca Insurance leverages advanced data analytics to gain insights into customer behavior, risk profiles, and market trends. The company uses these insights to:

- Personalize Product Offerings: By analyzing customer data, Ameca Insurance can tailor insurance policies to meet individual needs and preferences, offering competitive premiums and customized coverage options.

- Optimize Risk Assessment: Data analytics enables Ameca Insurance to identify potential risks more accurately and develop predictive models for risk management, leading to more efficient pricing and underwriting processes.

- Improve Claims Handling: By analyzing claims data, Ameca Insurance can identify patterns and trends, optimize claims processes, and reduce fraudulent activity.

“Data analytics is a powerful tool that allows us to understand our customers better, identify emerging risks, and develop innovative solutions that meet their evolving needs,” said [Name], Chief Technology Officer at Ameca Insurance.

Artificial Intelligence (AI) and Chatbots

Ameca Insurance is implementing AI-powered chatbots to enhance customer service and automate routine tasks. These chatbots provide 24/7 support, answering frequently asked questions, resolving simple inquiries, and guiding customers through common processes. The use of AI chatbots:

- Improves Response Times: Customers receive immediate responses to their queries, reducing wait times and improving customer satisfaction.

- Reduces Human Error: AI chatbots provide consistent and accurate information, minimizing the risk of human error in customer interactions.

- Frees Up Agents for Complex Tasks: By handling routine inquiries, chatbots allow customer service agents to focus on more complex and personalized issues, enhancing their overall productivity.

Blockchain Technology for Secure Transactions

Ameca Insurance is exploring the potential of blockchain technology to enhance the security and transparency of its operations. Blockchain can be used to:

- Secure Policy Data: Blockchain provides a decentralized and immutable ledger for storing policy information, ensuring data integrity and preventing unauthorized access.

- Streamline Claims Processing: Blockchain can facilitate the secure and transparent exchange of claims data between parties involved, speeding up the claims process and reducing disputes.

- Enhance Payment Security: Blockchain can enable secure and efficient payment processing, reducing the risk of fraud and minimizing transaction costs.

Ameca Insurance’s commitment to technological innovation ensures that the company remains at the forefront of the insurance industry, providing its customers with exceptional experiences and value.

Sustainability and Social Responsibility

Ameca Insurance is committed to operating in a sustainable and responsible manner, recognizing the interconnectedness of environmental, social, and economic factors. The company strives to integrate sustainability into its core business practices, aiming to create positive impact within its communities and the wider world.

Environmental Sustainability Initiatives

Ameca Insurance actively implements initiatives to minimize its environmental footprint and promote sustainable practices.

- Paperless Operations: Ameca Insurance has transitioned to digital processes for most of its operations, reducing paper consumption and promoting efficient document management. This includes online policy applications, electronic communication, and digital claim submissions.

- Energy Efficiency: The company invests in energy-efficient technologies and practices within its offices, such as LED lighting, smart thermostats, and energy-efficient appliances. These measures contribute to reducing energy consumption and minimizing carbon emissions.

- Green Procurement: Ameca Insurance prioritizes sourcing products and services from suppliers who demonstrate commitment to environmental sustainability. This includes considering factors like recycled content, renewable energy use, and responsible waste management.

Community Engagement and Social Responsibility

Ameca Insurance recognizes its responsibility to contribute to the well-being of its communities and supports various initiatives aimed at promoting social good.

- Community Partnerships: Ameca Insurance actively partners with local organizations and charities focused on areas such as education, healthcare, and disaster relief. These partnerships involve financial contributions, volunteer efforts, and collaborative projects.

- Employee Volunteering: Ameca Insurance encourages its employees to engage in volunteer activities within their communities. The company provides opportunities for employees to dedicate time and skills to organizations that align with its values.

- Financial Literacy Programs: Ameca Insurance offers financial literacy programs and workshops to individuals and communities. These programs aim to empower individuals with the knowledge and skills needed to make informed financial decisions.

Promoting Diversity, Equity, and Inclusion

Ameca Insurance recognizes the importance of fostering a diverse and inclusive workplace. The company actively promotes equal opportunities and creates a welcoming environment for employees from all backgrounds.

- Diversity and Inclusion Training: Ameca Insurance provides training programs to employees on diversity, equity, and inclusion, aiming to raise awareness and promote understanding of different perspectives.

- Employee Resource Groups: The company supports employee resource groups that represent diverse identities and interests. These groups provide a platform for employees to connect, share experiences, and advocate for inclusive practices.

- Recruitment and Retention Practices: Ameca Insurance implements recruitment and retention practices that prioritize diversity and inclusion. This includes actively seeking talent from underrepresented groups and creating a workplace culture that values and celebrates diversity.

Future Outlook and Growth Strategies

Ameca Insurance is well-positioned to capitalize on the evolving insurance landscape, driven by technological advancements, changing customer expectations, and a growing demand for customized and personalized solutions. The company’s strategic focus on innovation, customer-centricity, and financial stability will be crucial in navigating the industry’s future trajectory.

Industry Trends and Their Impact

The insurance industry is undergoing a period of rapid transformation, driven by several key trends that are shaping the competitive landscape and customer expectations. These trends present both opportunities and challenges for Ameca Insurance, requiring a proactive and adaptive approach.

- Digitalization and Technology: The adoption of digital technologies, such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT), is revolutionizing the insurance industry. AI-powered chatbots and virtual assistants are enhancing customer service, while data analytics and predictive modeling are improving risk assessment and pricing. Ameca Insurance can leverage these technologies to streamline operations, personalize customer experiences, and develop innovative products and services.

- Customer Expectations: Consumers are increasingly demanding personalized experiences, seamless digital interactions, and instant gratification. They expect insurance companies to be responsive, transparent, and digitally savvy. Ameca Insurance can meet these expectations by investing in user-friendly digital platforms, providing personalized recommendations, and offering convenient digital claim filing and resolution processes.

- Shifting Demographics: The aging population and the rise of millennials are influencing insurance demand. Older generations are increasingly seeking long-term care and health insurance, while millennials are more interested in digital-first insurance solutions. Ameca Insurance can adapt its product offerings and marketing strategies to cater to these diverse demographic segments.

- Climate Change and Sustainability: Climate change is increasing the frequency and severity of natural disasters, leading to higher insurance claims and premiums. Ameca Insurance can play a role in promoting sustainability by offering insurance products that incentivize environmentally friendly practices and by investing in climate-resilient infrastructure.

Growth Plans and Expansion Strategies

Ameca Insurance has a clear vision for future growth, focusing on expanding its market reach, diversifying its product offerings, and strengthening its digital capabilities. The company’s growth strategy encompasses several key initiatives:

- Geographic Expansion: Ameca Insurance plans to expand its operations into new markets, both domestically and internationally. This will involve identifying regions with strong growth potential and developing tailored insurance solutions to meet the specific needs of those markets. For example, the company could explore expanding into emerging markets with a high growth rate in insurance penetration, such as certain countries in Southeast Asia or Africa.

- Product Diversification: Ameca Insurance is committed to diversifying its product portfolio by developing new insurance products and services that cater to evolving customer needs. This could include innovative products focused on emerging risks, such as cyber security or data breaches, or tailored solutions for specific industries, such as technology or healthcare.

- Digital Transformation: Ameca Insurance recognizes the importance of embracing digital technologies to enhance customer experiences, improve efficiency, and gain a competitive advantage. The company will continue to invest in its digital infrastructure, develop new digital products and services, and leverage data analytics to personalize customer interactions.

- Strategic Partnerships: Ameca Insurance plans to forge strategic partnerships with other companies in the insurance ecosystem, such as technology providers, fintech companies, and insurance brokers. These partnerships will enable the company to access new technologies, expand its distribution channels, and enhance its product offerings.

Potential Challenges and Opportunities

Ameca Insurance is well-positioned for future growth, but it will need to navigate several potential challenges and capitalize on emerging opportunities.

- Regulatory Landscape: The insurance industry is subject to complex and evolving regulations, which can create challenges for companies seeking to innovate and expand their operations. Ameca Insurance will need to stay informed about regulatory changes and ensure compliance with all applicable laws and regulations.

- Cybersecurity Threats: The increasing reliance on digital technologies has heightened the risk of cyberattacks, which can disrupt operations, compromise customer data, and damage a company’s reputation. Ameca Insurance will need to invest in robust cybersecurity measures to protect its systems and customer information.

- Competition: The insurance industry is highly competitive, with established players and new entrants vying for market share. Ameca Insurance will need to differentiate itself through innovation, customer service, and a strong brand reputation.

- Economic Uncertainty: Global economic uncertainty can impact insurance demand and profitability. Ameca Insurance will need to be prepared for potential economic downturns and adjust its strategies accordingly.

- Emerging Technologies: The rapid pace of technological innovation presents both opportunities and challenges for the insurance industry. Ameca Insurance will need to stay abreast of emerging technologies and adapt its business model to leverage these innovations effectively.

Comparison with Other Insurance Providers

Ameca Insurance operates in a competitive market, facing established players and newer entrants vying for customers. This section compares Ameca’s products, services, and pricing with those of its competitors, highlighting its unique selling propositions and competitive advantages.

Product and Service Comparisons

A direct comparison of Ameca’s offerings with those of its competitors reveals key differences in product features, service levels, and pricing strategies.

- Product Features: Ameca Insurance offers a comprehensive suite of insurance products, including auto, home, health, and life insurance. Its products are designed to meet the specific needs of its target audience, offering features such as flexible payment options, customizable coverage, and value-added services. In comparison, some competitors may focus on specific product lines or offer limited customization options.

- Service Levels: Ameca prides itself on its exceptional customer service, providing 24/7 support, personalized advice, and efficient claims processing. In contrast, some competitors may have limited customer support hours or offer less personalized interactions.

- Pricing Strategies: Ameca offers competitive pricing, leveraging its strong financial position and efficient operations to provide value to its customers. While some competitors may offer lower premiums initially, they may have higher deductibles or limited coverage options, ultimately making Ameca’s offerings more cost-effective in the long run.

Competitive Advantages

Ameca Insurance differentiates itself from its competitors through its unique selling propositions, which provide a compelling value proposition to customers.

- Customer-Centric Approach: Ameca places a strong emphasis on customer satisfaction, prioritizing personalized service, transparent communication, and prompt issue resolution. This customer-centric approach has earned Ameca a loyal customer base and positive online reviews.

- Technology-Driven Solutions: Ameca leverages cutting-edge technology to streamline its operations, enhance customer experiences, and offer innovative solutions. This includes online quoting and policy management tools, mobile app access, and AI-powered claims processing.

- Strong Financial Stability: Ameca’s robust financial position and sound risk management practices provide customers with confidence in its long-term stability and ability to fulfill its obligations. This is a key differentiator in an industry characterized by occasional market volatility.

Comparison Table

The following table summarizes the key features and benefits of different insurance providers, highlighting Ameca’s competitive advantages:

| Provider | Product Range | Customer Service | Pricing | Technology | Financial Stability |

|---|---|---|---|---|---|

| Ameca Insurance | Comprehensive, customizable | Excellent, 24/7 support | Competitive, value-driven | Advanced, customer-focused | Strong, reliable |

| Competitor A | Limited product range | Average, limited hours | Low initial premiums, high deductibles | Basic, limited online tools | Moderate, some concerns |

| Competitor B | Wide range, limited customization | Good, responsive | Competitive, variable by region | Emerging, developing online presence | Strong, well-established |

Conclusion

Ameca Insurance presents a compelling case as a reliable and innovative insurance provider. Its strong financial standing, commitment to customer service, and focus on technology position it favorably within the competitive insurance landscape. However, Ameca can further enhance its offerings by addressing specific areas for improvement.

Strengths and Areas for Improvement

Ameca Insurance boasts several key strengths, including its:

- Financial Stability: Ameca’s robust financial performance, reflected in its strong capital reserves and consistent profitability, instills confidence in its ability to fulfill its obligations to policyholders.

- Customer Service Excellence: Ameca prioritizes customer satisfaction, evidenced by its responsive and personalized service, which contributes to high customer retention rates.

- Technological Innovation: Ameca’s investment in cutting-edge technology, including digital platforms and AI-powered solutions, streamlines processes and enhances the overall customer experience.

- Sustainability and Social Responsibility: Ameca’s commitment to environmental sustainability and social responsibility initiatives demonstrates its commitment to ethical practices and contributing to a positive societal impact.

While Ameca excels in several areas, it can further strengthen its position by:

- Expanding Product Offerings: Expanding its product portfolio to cater to a wider range of customer needs, such as specialized insurance products or niche markets, could attract a broader customer base.

- Enhancing Claims Processing: Optimizing its claims processing procedures, including faster turnaround times and streamlined communication, can improve customer satisfaction during challenging situations.

- Strengthening Brand Awareness: Implementing targeted marketing campaigns and engaging in strategic partnerships can enhance brand recognition and attract new customers.

Final Thoughts

In an industry often characterized by complex jargon and convoluted processes, Ameca Insurance stands out for its commitment to transparency, accessibility, and customer-centricity. By prioritizing the needs of its policyholders, Ameca Insurance has cultivated a loyal following, solidifying its position as a leading provider of insurance solutions.

Whether you’re seeking comprehensive protection for your home, vehicle, or business, or simply require peace of mind knowing you’re covered in the event of life’s unforeseen circumstances, Ameca Insurance offers a range of products tailored to your specific requirements. With its unwavering dedication to customer satisfaction and its commitment to ethical business practices, Ameca Insurance remains a trusted partner in securing your future.