Insurance companies routinely inundate consumers with offers, but the frequency varies dramatically. This analysis delves into the complex factors influencing the number of offers, from customer demographics and claims history to digitalization and competitive pressures. Understanding these dynamics is crucial for both insurers and consumers alike.

This exploration examines the typical range of offers made, considering various policy types. We’ll also analyze the methods used to assess risk and generate customized offers, along with how customer preferences and digital technologies shape the process.

Insurance Offer Frequency

Insurance companies routinely assess risk and tailor premiums to individual circumstances. The frequency of offers, however, varies widely depending on the type of policy and the insurer’s internal procedures. This dynamic process reflects the complex interplay of market forces, competitive pressures, and the need to accurately price risk.

Typical Range of Offers

Insurance companies typically make offers based on a range of factors. For auto insurance, a common practice is to generate multiple offers, often reflecting different coverage levels and deductibles. Home insurance offers, similarly, might encompass various policy options, from basic coverage to comprehensive protection. Life insurance often involves a more individualized approach, with companies making fewer offers, typically based on detailed health assessments and lifestyle information.

Health insurance offers, often influenced by eligibility requirements and pre-existing conditions, can vary considerably in number. This demonstrates a nuanced understanding of individual risk profiles and policy complexities.

Factors Influencing Offer Frequency

Several factors influence the number of offers an insurance company generates. Customer demographics, including age, location, and driving history, significantly impact the risk assessment. Policy specifics, such as the desired coverage level, deductibles, and add-ons, also affect the number of potential offers. Furthermore, competitive pressures in the market, particularly for auto and home insurance, can drive insurers to make multiple offers to attract customers.

Internal company procedures, including underwriting guidelines and the availability of data analytics, can further shape the frequency of offers. Finally, the type of policy greatly influences the process, as life insurance often requires a more personalized approach.

Offer Generation Process Differences

The processes of offer generation vary among insurers. Some companies employ sophisticated algorithms to quickly generate a range of offers based on a customer’s input. Others rely on more manual processes, potentially involving human underwriters to evaluate each applicant’s risk profile. This difference in approach can significantly impact the speed and number of offers received. For example, some insurers might produce multiple offers simultaneously, while others might focus on a more targeted approach, making fewer but more personalized offers.

This diversity reflects the varied strategies and capabilities of different insurance providers.

Comparison of Offer Frequencies Across Insurance Types

| Insurance Type | Typical Offer Frequency | Factors Influencing Frequency |

|---|---|---|

| Auto | High (multiple offers often generated) | Driving history, location, coverage desired |

| Home | Moderate (several options usually presented) | Home value, location, desired coverage level |

| Life | Low (fewer, more individualized offers) | Health status, lifestyle, coverage amount |

| Health | Variable (depends on specific needs and eligibility) | Pre-existing conditions, coverage requirements, location |

The table illustrates the broad spectrum of offer frequencies across different insurance types, highlighting the influence of key factors. It is important to remember that these are general guidelines and actual frequencies can vary greatly depending on individual circumstances and the specific insurer.

Factors Influencing Offers

Insurance companies tailor their offerings to individual risk profiles, a complex process influenced by a multitude of factors. This necessitates a nuanced understanding of the variables at play to ensure accurate pricing and appropriate coverage. Understanding these variables is crucial for both consumers and insurers, fostering a more transparent and efficient market.Customer demographics, geographic location, claims history, and risk profiles all play a significant role in determining the number of insurance offers an individual receives.

These factors are not isolated; they interact in intricate ways, impacting the perceived risk associated with a particular customer. The goal is to present relevant options while avoiding overwhelming the consumer with irrelevant or unsuitable choices.

Customer Demographics and Offer Frequency

Customer demographics, including age, location, occupation, and family status, significantly impact insurance offer frequency. Younger drivers, for example, are often presented with more aggressive premium options than their older counterparts. This is a direct reflection of the perceived risk associated with their driving habits. Similarly, those in high-risk occupations, like professional athletes, may encounter higher premiums and fewer choices compared to office workers.

The frequency of offers is adjusted based on the anticipated claim frequency and severity, informed by historical data on claims patterns within specific demographic groups.

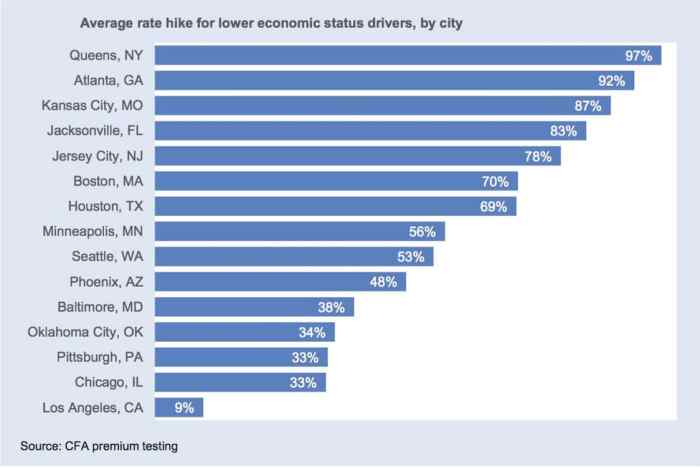

Geographic Location and Offer Counts

Geographic location significantly affects the number of offers presented. Areas with higher crime rates, for example, may see insurance companies presenting fewer options and higher premiums for auto and home insurance. Conversely, areas with lower crime rates and a history of fewer natural disasters tend to have more choices and lower premiums. This variation is based on a detailed analysis of claims data, factoring in historical patterns of accidents, theft, and natural calamities within different regions.

Claims History and Offer Presentation

Claims history profoundly influences the number of insurance offers. Individuals with a history of multiple claims often receive fewer options and higher premiums, reflecting the higher perceived risk. This is due to the statistically higher likelihood of future claims for those with a history of past claims. Conversely, those with a clean claims history typically have more options and potentially lower premiums, as their risk profile suggests a lower likelihood of future claims.

Insurers carefully analyze this data to adjust the offer frequency and premiums accordingly.

Risk Profile and Offer Frequency

| Risk Profile | Number of Offers | Premium | Explanation |

|---|---|---|---|

| Low Risk | High | Low | Individuals with a clean claims history and favorable demographics often receive a wide array of options and competitive premiums. |

| Medium Risk | Medium | Medium | Customers with a moderate claims history and demographics fall between the extremes, receiving a moderate number of offers with premiums reflecting their risk level. |

| High Risk | Low | High | Individuals with a history of frequent claims and unfavorable demographics are presented with a limited number of options and higher premiums due to their elevated risk profile. |

This table illustrates the direct correlation between risk profiles and the number of offers received. Insurers employ sophisticated algorithms to categorize individuals into these risk profiles, incorporating various data points to estimate future claims likelihood. These algorithms consider the customer’s history, demographics, and location, among other factors.

Offer Generation Process

Insurance companies meticulously craft customized offers to attract and retain customers. This process involves a complex interplay of risk assessment, customer data analysis, and sophisticated technology. The goal is to present competitive, tailored offerings that resonate with individual needs and preferences, ultimately boosting profitability and customer satisfaction.

Stages in the Offer Creation Process

The creation of insurance offers follows a systematic process, typically involving several stages. These stages are designed to ensure accuracy, efficiency, and alignment with customer requirements.

- Data Collection and Analysis: Insurance companies gather extensive data from various sources, including customer profiles, claims history, demographics, and market trends. This data is then meticulously analyzed to identify patterns and predict future risk factors. Sophisticated algorithms help to quantify risk levels, ensuring offers are aligned with anticipated liabilities. For instance, a customer with a history of minor car accidents might be assessed as having a higher risk of future claims, impacting the premium calculated.

- Risk Assessment and Modeling: Using advanced actuarial models and statistical techniques, insurance companies evaluate the potential risk associated with each policy. Factors like driving history, occupation, location, and pre-existing medical conditions are considered in this crucial step. Sophisticated risk modeling helps to determine the appropriate premium for each policy, accounting for the potential financial burden of claims. For example, a policy for a driver with a clean driving record and living in a low-accident area would likely have a lower premium compared to a driver with multiple accidents or living in a high-accident zone.

- Offer Customization: The data and risk assessment are used to generate customized offers. These offers are tailored to individual customer needs, reflecting their specific circumstances and preferences. This often involves offering various policy options, premium amounts, and coverage levels. An example might include offering a lower premium with a higher deductible to appeal to customers seeking affordability, or providing multiple coverage options to address varying needs and budgets.

- Presentation and Communication: The generated offers are presented to customers through various channels, including online portals, mobile apps, and direct mail. The presentation is crucial, ensuring clear and concise communication of policy terms and conditions, premium amounts, and coverage details. Modern platforms often use interactive tools to allow customers to compare different options and tailor their policies to their specific needs.

- Policy Issuance and Administration: Once a customer selects an offer, the policy is issued and the insurance company takes on the responsibility of managing claims, payments, and policy administration. This stage ensures smooth transitions and transparent operations for all parties involved.

Methods for Assessing Risk and Generating Offers

Insurance companies employ a variety of methods to assess risk and generate customized offers. These methods are constantly evolving to meet the demands of a dynamic market and improve accuracy in predicting risk.

- Actuarial Modeling: Sophisticated actuarial models are used to analyze historical data and predict future claims. These models consider various factors such as age, gender, location, and driving habits to calculate risk and premium levels. Actuarial models often use complex statistical techniques, including regression analysis and machine learning, to identify patterns and predict future outcomes.

- Machine Learning Algorithms: Machine learning algorithms are increasingly used to identify patterns and predict risks in customer data that traditional methods might miss. These algorithms analyze vast amounts of data to identify correlations between various factors and predict future claims more accurately. For instance, a machine learning algorithm can detect subtle patterns in a driver’s behavior that could indicate a higher risk of accidents, allowing for more precise premium calculation.

- Data Analytics: Data analytics plays a crucial role in evaluating customer data, identifying trends, and improving the accuracy of risk assessments. Data analysis techniques help to identify correlations between various factors and predict future claims more accurately. By analyzing large datasets, insurance companies can identify patterns and predict future claims with greater precision.

Technology in Offer Generation

Modern insurance companies rely on sophisticated technology to streamline the offer generation process. Technology helps to automate tasks, improve accuracy, and enhance customer experience.

- Customer Relationship Management (CRM) Systems: CRM systems manage customer interactions, track policy details, and facilitate communication. These systems store valuable information and automate tasks such as policy renewal reminders and claims processing, enhancing efficiency and customer satisfaction. These systems allow for a holistic view of each customer, facilitating personalized communication and offers.

- Online Portals and Mobile Apps: Online portals and mobile apps provide customers with easy access to information, policy details, and the ability to manage their accounts. These tools allow for efficient offer generation and distribution, improving customer experience. Customers can easily compare different options, customize their policies, and manage their accounts conveniently.

- Cloud Computing: Cloud computing allows insurance companies to store and process large amounts of data securely and efficiently. Cloud-based platforms provide scalability and flexibility, accommodating increasing data volumes and customer needs. This ensures rapid processing and access to data for real-time offer generation.

Impact of Customer Preferences

Understanding and responding to customer preferences is essential in creating effective insurance offers. Factors like affordability, coverage options, and ease of use influence customer choices.

- Customization Options: Customers often desire customization options in their insurance policies. Offering various coverage levels, deductibles, and add-on benefits allows customers to tailor their policies to their unique needs and budgets. For instance, a young professional might choose a policy with a lower premium but higher deductible to save money.

- Accessibility and Convenience: Ease of access and convenient online platforms are increasingly important to customers. Providing online portals, mobile apps, and easy-to-understand policy documents can significantly enhance the customer experience. This approach often leads to increased customer satisfaction and engagement.

- Affordability: Price sensitivity remains a crucial factor. Customers are often attracted to policies that offer a balance between adequate coverage and affordable premiums. Offering various options with varying premiums allows for greater customer choice and affordability.

Offer Generation Process Steps

| Step | Description |

|---|---|

| 1 | Data Collection and Analysis |

| 2 | Risk Assessment and Modeling |

| 3 | Offer Customization |

| 4 | Presentation and Communication |

| 5 | Policy Issuance and Administration |

Comparison of Offer Strategies

Insurance companies employ diverse strategies to craft competitive offers, often adapting to market dynamics and customer preferences. Understanding these strategies provides crucial insight into the competitive landscape and the factors driving pricing decisions. This analysis explores the approaches used by different companies, highlighting commonalities and variations in their offer generation processes.

Competitive Pressures and Offer Strategies

Competitive pressures significantly influence the strategies employed by insurance companies. These pressures often stem from the need to attract and retain customers in a saturated market. Aggressive pricing tactics, bundled product offerings, and loyalty programs are common responses to competitive challenges. Companies that adapt to changing customer demands and technological advancements, such as personalized digital platforms for offer generation, are better positioned to succeed.

For example, a company introducing a mobile app allowing customers to instantly compare policies across providers demonstrates a response to the pressure to make the process easier and more transparent.

Comparison of Approaches by Different Insurance Companies

Various insurance companies adopt distinct strategies in generating offers. Some prioritize cost efficiency and standardized pricing models, while others emphasize personalized service and customized pricing based on individual risk profiles. The choice of approach often depends on factors such as company size, target market, and overall business strategy. For example, smaller insurers may focus on niche markets and customized offerings, while larger, more established companies might utilize a broader, more standardized approach.

Commonalities in Offer Generation Methods

Despite variations in approach, some common threads run through the offer generation methods of different insurance companies. These include the use of actuarial models to assess risk, the integration of data analytics to understand customer behavior, and the implementation of pricing algorithms to determine premiums. Companies increasingly rely on data-driven insights to personalize offers, potentially increasing customer satisfaction and engagement.

For instance, insurers may use historical claims data and demographics to adjust premiums for individual customers, reflecting their unique risk profile.

Table Comparing Different Offer Strategies

| Insurance Company | Offer Strategy | Focus | Competitive Advantage |

|---|---|---|---|

| Company A | Standardized pricing with tiered discounts | Cost efficiency, broad appeal | Competitive pricing, simplified process |

| Company B | Personalized pricing based on risk assessment | Customer-centric, targeted offers | Improved customer satisfaction, tailored premiums |

| Company C | Bundled product offerings with loyalty programs | Cross-selling, customer retention | Increased customer lifetime value, enhanced services |

| Company D | Value-based pricing with emphasis on coverage | Comprehensive coverage, premium transparency | Attracting customers seeking high-quality coverage |

Customer Interaction with Offers

Insurance customers typically receive multiple offers, often via email, online portals, or even phone calls. Understanding how these customers interact with these offers is crucial for insurers to optimize their strategies and improve conversion rates. This analysis delves into the process, from initial reception to final decision.

Typical Customer Interaction

Customers often encounter insurance offers as part of their regular online activity or through targeted marketing campaigns. The reception of these offers is usually passive, with customers encountering them while browsing or checking their accounts. This passive interaction can lead to varying levels of engagement. Some customers may quickly dismiss the offer, while others may take a more in-depth look.

Methods of Evaluation and Response

Customers employ various methods to evaluate insurance offers. These methods range from quick comparisons based on premiums to detailed analysis considering coverage and benefits. Tools like online comparison websites, spreadsheets, or even direct communication with agents are frequently used to compare different options. Customers often consider factors like price, coverage, deductibles, and any bundled services. This evaluation process is not always linear; customers may revisit offers at different points in their research.

Customer Interactions with Multiple Offers

Customers often receive multiple offers from different insurers. This situation necessitates a careful evaluation process. Customers may simultaneously compare offers from various companies, examining the features and pricing of each to determine the best fit. This often involves toggling between different insurance provider platforms, creating a complex interaction journey. For instance, a customer might compare coverage levels, deductibles, and policy terms from multiple providers before selecting the most suitable option.

Response Rates to Insurance Offers

Response rates to insurance offers vary considerably. Factors like the type of offer, the customer’s profile, and the clarity of the presentation all influence the likelihood of a response. High-value offers, tailored to specific customer needs, often yield higher response rates. Historical data suggests that the conversion rate for insurance offers can fluctuate widely, with some campaigns generating far higher response rates than others.

Flowchart of Customer Interaction

The following flowchart Artikels the typical steps involved in a customer’s interaction with insurance offers: [Note: A visual flowchart would replace this placeholder image. The flowchart would depict the stages, including: receiving the offer, reviewing the details, comparing with other offers, contacting the insurer, making a decision, and finalizing the purchase. Each stage would have a decision point, indicating whether the customer proceeds to the next stage or abandons the process.]

Impact of Digitalization on Offers

Digitalization is fundamentally reshaping the insurance industry, particularly in how companies present and tailor offers to customers. This transformation is driven by the need for greater efficiency, personalization, and data-driven decision-making. The increased use of digital technologies has a profound impact on the volume and nature of insurance offers, from the initial generation to the final customer interaction.The adoption of digital tools and platforms has dramatically altered the insurance offer process.

Traditional methods, often reliant on manual processes and limited data sets, are being superseded by automated systems that can generate a multitude of tailored offers in a fraction of the time. This shift not only increases the frequency of offers but also allows for a more personalized and targeted approach, potentially improving customer satisfaction and sales conversion rates.

Impact on Offer Frequency

Digitalization empowers insurance companies to analyze vast amounts of data and market conditions in real-time. This instantaneous analysis allows for the rapid generation of numerous offers, often exceeding the capacity of traditional manual processes. Consequently, customers are presented with a wider array of options, potentially leading to better matches between customer needs and available policies.

Role of AI and Machine Learning in Optimizing Offer Generation

Artificial intelligence (AI) and machine learning (ML) algorithms are becoming integral to the offer generation process. AI can analyze customer profiles, risk assessments, and market trends to identify optimal policy structures and premiums, significantly improving the precision of offer generation. This data-driven approach enables the identification of previously untapped market segments, leading to the creation of more competitive and targeted offers.

For example, a company might use AI to identify a group of customers with a specific risk profile and then tailor a tailored insurance package for them.

Benefits of Digital Platforms in Streamlining the Offer Process

Digital platforms streamline the offer generation and delivery process, significantly reducing manual intervention. Automated systems can quickly process applications, assess risks, and generate personalized offers, cutting down on turnaround times. This efficiency translates into faster responses for customers and enhanced productivity for the insurance companies. Companies can potentially reduce their operating costs by automating tasks, and more readily adapt to market changes.

Personalization of Offers Through Digital Tools

Digital tools facilitate the personalization of insurance offers. By leveraging customer data, digital platforms can create highly tailored policies, reflecting individual needs and risk profiles. This targeted approach improves the customer experience and increases the likelihood of a successful sale. Examples include customized coverage amounts, premiums, and policy terms, reflecting individual circumstances and preferences.

Evolution of Offer Generation Methods

| Time Period | Method | Description |

|---|---|---|

| Pre-Digital Era | Manual processes | Offers generated manually based on limited data and expert judgment. |

| Early Digitalization | Basic software systems | Automation of some processes, but still limited data analysis capabilities. |

| Present Day | AI-powered systems | Sophisticated algorithms analyze vast data sets to generate numerous personalized offers quickly and efficiently. |

Industry Trends and Future Predictions

The insurance industry is undergoing a rapid transformation, driven by evolving customer expectations, technological advancements, and regulatory shifts. Offer generation, a critical component of this process, is adapting to these changes, with companies exploring innovative strategies to enhance customer engagement and profitability. This evolution presents both opportunities and challenges for insurers.The future of insurance offers hinges on understanding and anticipating these trends.

The industry’s response to these forces will dictate its ability to maintain competitiveness and meet the demands of a digitally-savvy clientele. The following sections examine key areas of predicted change and the potential impact of emerging factors.

Current Trends in Offer Generation

The insurance industry is witnessing a shift towards personalized and proactive offer generation. Companies are leveraging data analytics to understand individual customer needs and preferences, enabling the creation of tailored product recommendations. This approach is proving effective in increasing customer engagement and conversion rates. Examples include insurers using historical claims data to predict future risk and proactively offering preventive measures.

Further, the use of AI-powered tools is allowing insurers to automate the offer generation process, streamlining operations and reducing costs.

Predicted Changes in Offer Frequency and Strategies

The frequency and strategies behind insurance offers are expected to evolve significantly. Proactive, rather than reactive, approaches will likely become more prevalent. Insurers are predicted to move away from broad, generic offers towards targeted and personalized ones, leveraging data to identify high-potential customers. This could lead to more frequent, but less intrusive, offers aligned with individual customer needs.

For instance, a driver with a low accident history might receive a more frequent offer for reduced premiums.

Potential Impact of New Regulations on Offer Generation

New regulations are likely to influence offer generation practices. Increased scrutiny on data privacy and transparency will require insurers to adopt more ethical and customer-centric strategies. Compliance with these regulations will necessitate significant changes in how offers are generated, presented, and communicated. Examples include enhanced transparency in pricing models and greater customer control over their data.

Emerging Technologies Affecting Offer Presentation

Emerging technologies, such as artificial intelligence (AI) and machine learning (ML), are poised to revolutionize offer presentation. AI-powered chatbots can provide real-time customer support and personalized recommendations. Further, virtual reality (VR) and augmented reality (AR) technologies may enhance the customer experience by allowing them to visualize and interact with insurance products in immersive ways. For instance, a VR simulation could demonstrate the financial implications of various coverage options.

Future of Offer Generation

| Factor | Predicted Trend |

|---|---|

| Offer Frequency | More frequent, personalized offers based on individual needs and risk profiles. |

| Offer Strategy | Proactive and data-driven strategies focusing on customer segmentation and tailored recommendations. |

| Regulatory Impact | Increased transparency, data privacy, and customer control over data, leading to ethical offer generation. |

| Technology Impact | AI-powered personalization, chatbots, VR/AR simulations enhancing the customer experience. |

Offer Presentation Methods

Insurance companies employ a variety of methods to present offers, reflecting the diverse needs and preferences of their customer base. From straightforward email notifications to personalized online portals, the approach must balance clarity and conciseness with engagement and comprehensiveness. A well-structured presentation method can significantly impact customer perception and ultimately, conversion rates.

Different Presentation Channels

Various channels are used to deliver insurance offers. Direct mail, email campaigns, and online portals are common methods. The optimal channel selection depends heavily on factors such as the target customer demographic, the type of insurance product, and the desired level of interaction. Email campaigns are cost-effective for broad reach, while personalized online portals facilitate in-depth comparisons and policy customization.

Comparative Analysis of Presentation Methods

Different presentation methods have varying levels of effectiveness. A direct mail approach, while potentially impactful, often has higher costs and lower response rates compared to digital channels. Email marketing, with its targeted approach and trackable metrics, allows for more efficient communication. Online portals, enabling real-time comparisons and customization, offer a powerful tool for driving conversions. The chosen method should align with the insurance company’s marketing budget and its specific goals for the offer.

Best Practices for Clear and Concise Presentation

Clarity and conciseness are paramount in insurance offer presentations. Use plain language, avoid jargon, and clearly highlight key benefits. Bullet points, tables, and visual aids enhance comprehension. The offer presentation should clearly Artikel the coverage details, premiums, and any associated fees. Avoid overwhelming customers with excessive information.

Provide clear and accessible contact information for any questions.

Illustrative Presentation Styles

Different styles can enhance the presentation of insurance offers. A simple, yet well-designed email template can be highly effective. The email should clearly state the offer details and include a clear call to action, such as a link to a detailed policy overview. An online portal, with user-friendly navigation and intuitive comparisons, facilitates a more interactive and comprehensive experience.

A well-structured webpage with clear, concise information on different policy options and cost breakdowns is ideal for those looking for detailed information.

Offer Presentation Formats

| Presentation Format | Description | Effectiveness |

|---|---|---|

| Email with Summary | A concise email outlining key features, benefits, and a call to action. | High for initial awareness, potentially low for detailed consideration. |

| Online Portal with Interactive Comparison Tool | A platform allowing customers to compare different policies, customize coverage, and see real-time premium calculations. | High for engagement and conversion; requires robust design and functionality. |

| Personalized Website Landing Page | A dedicated webpage tailored to a specific offer with detailed product information and visuals. | High for targeted marketing and detailed information; requires significant content creation. |

| Direct Mail with Brochures | Physical brochures with detailed information about the offer, frequently used for high-value policies. | Potentially high for engagement, but low for tracking and personalization. |

Geographical Variations in Offer Frequency

Insurance offer frequency isn’t uniform across geographies. Factors like local competition, market saturation, and consumer demographics significantly influence the number of offers an insurer presents to potential customers. Understanding these regional nuances is crucial for insurers to tailor their strategies and maximize effectiveness.Geographical location significantly impacts the volume of insurance offers. Different regions exhibit varying levels of competition, market maturity, and customer profiles.

These variations dictate the frequency and types of offers insurers deploy. This analysis delves into the specific drivers behind these differences, highlighting the importance of localized strategies in the insurance industry.

Impact of Competition

Competitive landscapes greatly influence offer frequency. In highly competitive regions, insurers may offer more frequent and attractive deals to attract customers. Conversely, in less competitive markets, the frequency of offers might be lower, with insurers potentially relying on established brand reputation and pricing models. For instance, a region with multiple established players and new entrants in the market might see more aggressive offer strategies, compared to a region with a more consolidated market structure.

Market Saturation and Customer Profiles

Market saturation plays a pivotal role. In saturated markets, where many similar products already exist, insurance companies might deploy more frequent and targeted offers to differentiate their products and capture market share. The customer profile also matters. In regions with a higher proportion of affluent customers, insurers might offer premium, customized plans with a lesser frequency of general offers, compared to areas with a more price-sensitive customer base.

Different demographics and economic conditions lead to variations in insurance needs and the associated offer frequency.

Regional Offer Frequency Data

The frequency of insurance offers varies considerably across regions. Analyzing this variance requires detailed regional data. Unfortunately, proprietary data on offer frequency is often not publicly available. However, one can infer regional differences from observable market trends and reported strategies. For example, highly competitive insurance markets in certain US states consistently demonstrate higher offer frequency, as insurers aggressively compete for market share.

Conversely, less competitive markets might see a lower frequency of offers.

Visual Representation of Data

A map visualization would best illustrate the geographical variations. The map would depict different regions colored according to the average frequency of insurance offers in each region. For example, a deep red color might represent regions with a very high frequency, while a light blue might indicate regions with a lower frequency. This visual representation would immediately convey the disparities across various geographical areas.

A chart could display offer frequency data alongside factors like market saturation and competitive intensity, providing a comparative analysis of the impact of these factors on offer generation.

Closure

In conclusion, the number of insurance offers depends on a multifaceted interplay of factors, from customer profiles and claims history to regional variations and competitive pressures. Digitalization is significantly impacting offer generation, leading to personalized and streamlined processes. Understanding these trends is vital for both consumers navigating the offer landscape and insurers seeking to optimize their strategies.