USAA Car Insurance: A Deep Dive into Quotes, Coverage, and Customer Experience

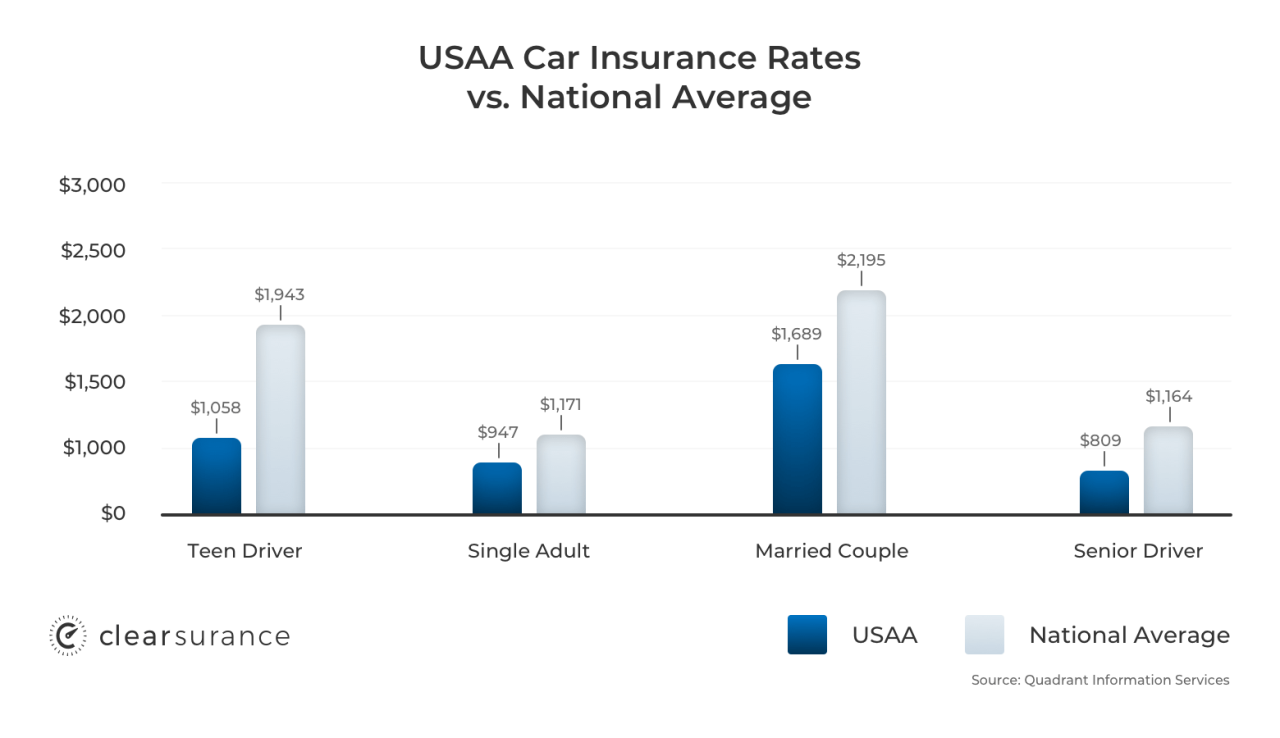

For military families and veterans, USAA is often the first name that comes to mind when considering car insurance. Known for its dedication to serving those who serve, USAA has built a reputation for exceptional customer service and competitive rates. But how does USAA stack up against other major insurers? This in-depth analysis explores the key features, customer experiences, and financial stability of USAA car insurance, providing insights for those seeking a comprehensive understanding of this unique provider. From its origins as a mutual aid society for military officers to its current status as a leading financial institution, USAA has consistently prioritized the needs of its members. This commitment to service extends to its car insurance offerings, which are designed to cater to the specific requirements of military personnel and their families. Whether you’re a seasoned veteran or a new recruit, understanding the intricacies of USAA car insurance can help you make informed decisions about your coverage and financial protection. USAA Overview USAA, a financial services company, is known for its long history and dedication to serving the military community. Founded in 1922 by a group of Army officers, USAA’s primary focus is on providing insurance and financial products to active-duty military members, veterans, and their families. The company’s mission is to ”facilitate the financial security of its members, their families and the communities they serve.” USAA’s Core Values and Principles USAA’s core values are rooted in its founding principles of integrity, loyalty, and service. These values are evident in its commitment to providing exceptional customer service, fair and competitive products, and financial stability. USAA’s commitment to these principles has earned it a reputation for reliability and trustworthiness among its members. USAA’s Membership Eligibility Criteria USAA membership is exclusive to individuals who meet specific criteria. The following are the eligibility requirements for becoming a USAA member: Active-duty military personnel in the U.S. Army, Navy, Air Force, Marines, Coast Guard, and Space Force. Veterans of the U.S. military who have served honorably. Current or former cadets at the U.S. Military Academy, U.S. Naval Academy, U.S. Air Force Academy, or U.S. Coast Guard Academy. Spouses and unmarried children of eligible members. Surviving spouses of eligible members. USAA Car Insurance Features USAA, a financial services company specializing in serving military members and their families, offers a comprehensive car insurance product with features designed to meet the unique needs of its target audience. The company’s car insurance policies are known for their robust coverage options, competitive pricing, and a range of value-added benefits. Coverage Options USAA’s car insurance provides a variety of coverage options to meet the diverse needs of its policyholders. Liability Coverage: This essential coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. It typically includes bodily injury liability and property damage liability coverage. Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive Coverage: This coverage protects your vehicle against damages caused by non-accident events such as theft, vandalism, fire, or natural disasters. Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who is uninsured or underinsured. It can help cover your medical expenses and property damage. Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It’s typically required in certain states. Rental Reimbursement: This coverage provides financial assistance for rental car expenses if your vehicle is damaged and unable to be driven. Roadside Assistance: This coverage provides assistance with services such as towing, jump starts, flat tire changes, and lockout assistance. Pricing and Discounts USAA’s car insurance pricing is based on a variety of factors, including your driving history, vehicle type, location, and coverage options. However, the company offers a range of discounts to help policyholders save money. Good Driver Discount: This discount is offered to drivers with a clean driving record and no recent accidents or violations. Safe Driver Discount: This discount is typically awarded to drivers who complete a defensive driving course. Multi-Policy Discount: USAA offers a discount to policyholders who bundle multiple insurance policies, such as home, auto, and life insurance, with the company. Military Discounts: USAA offers discounts specifically for military members, including active duty, retired, and veterans. Other Discounts: USAA may offer additional discounts for features like anti-theft devices, advanced safety features, and good credit history. Unique Benefits USAA goes beyond standard car insurance features to provide unique benefits for its members. Accident Forgiveness: USAA offers accident forgiveness, which prevents your premium from increasing after your first at-fault accident. This benefit can be valuable for drivers who may have a minor accident but otherwise have a good driving record. 24/7 Customer Support: USAA provides 24/7 customer support through phone, email, and online chat, ensuring assistance whenever needed. Mobile App: The USAA mobile app allows policyholders to manage their policies, file claims, access roadside assistance, and find local service providers, all from their smartphone. Financial Planning Services: As a comprehensive financial services company, USAA offers financial planning services, including retirement planning, investment management, and estate planning, which can be beneficial for military families. Customer Experience with USAA USAA’s commitment to providing exceptional customer service is a cornerstone of its brand identity. This dedication translates into a consistently high level of customer satisfaction, reflected in numerous positive reviews and testimonials. Customer Testimonials and Reviews USAA consistently receives high ratings for customer satisfaction from various independent organizations. For example, J.D. Power consistently ranks USAA among the top auto insurers for customer satisfaction. “USAA is the best insurance company I have ever dealt with. They are always helpful, friendly, and professional. I have been a member for over 20 years and have never had a bad experience.” - John S., a USAA customer. “I was in an accident recently and USAA handled everything so smoothly. They were there every step of the way, and I was able to get my car fixed quickly. I would recommend USAA to anyone.” - Sarah M., a USAA customer. Customer Service Channels and Response Times USAA offers multiple customer service channels, including phone, email, and online chat. The company is known for its quick response times and helpful customer service representatives. USAA’s phone lines are typically answered quickly, with average wait times being significantly lower than industry averages. Email inquiries are usually responded to within 24 hours, with many receiving a response within a few hours. USAA’s online chat service provides immediate assistance with common questions and issues. Claims Handling Process and Customer Satisfaction Ratings USAA’s claims handling process is designed to be efficient and customer-centric. The company has a dedicated claims team that works to resolve claims promptly and fairly. USAA offers a variety of options for filing claims, including online, phone, and mobile app. The company’s claims process is straightforward and transparent, with clear communication throughout the process. USAA’s claims adjusters are highly trained and experienced, ensuring fair and accurate assessments of damages. USAA’s commitment to exceptional customer service is evident in its high customer satisfaction ratings. The company consistently receives praise for its claims handling process, response times, and overall customer experience. USAA Car Insurance vs. Competitors … Read more