Ameca Insurance: A Comprehensive Guide to Your Protection

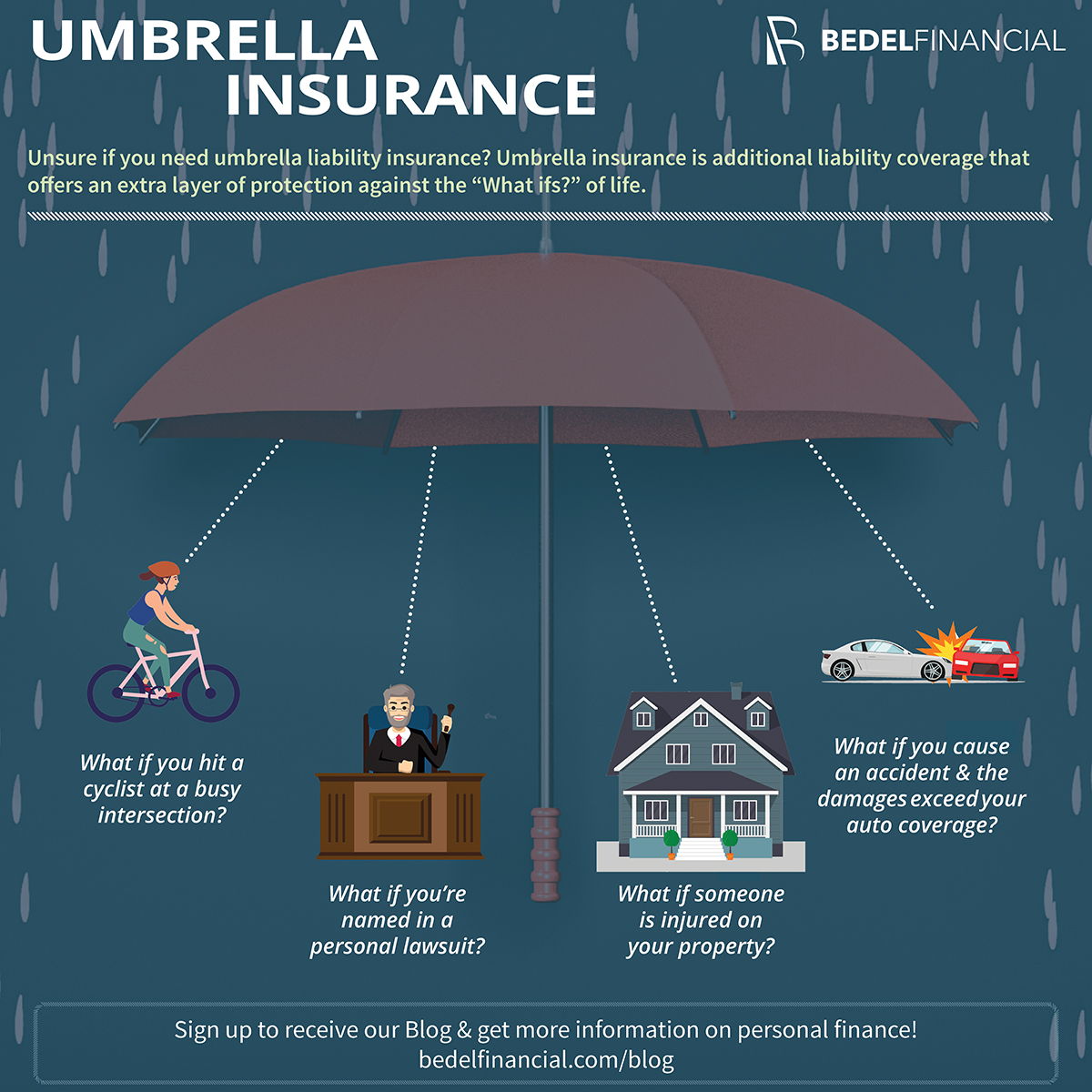

Ameca Insurance stands as a beacon of security and stability in the ever-evolving world of insurance. Founded on a bedrock of trust and a commitment to customer well-being, Ameca Insurance has carved a unique niche for itself, offering a diverse range of insurance products designed to cater to the specific needs of its target audience. From its humble beginnings, Ameca Insurance has grown into a respected and reputable name in the industry, earning the trust of countless individuals and families seeking comprehensive protection. The company’s unwavering focus on innovation and customer satisfaction has propelled its growth, ensuring that Ameca Insurance remains a trusted partner in navigating the complexities of life’s uncertainties. Introduction to Ameca Insurance Ameca Insurance is a leading provider of insurance solutions, committed to offering comprehensive coverage and exceptional customer service. Established in [Year of establishment], Ameca Insurance has grown to become a trusted name in the industry, known for its innovative products and customer-centric approach. Ameca Insurance’s mission is to empower individuals and businesses with the peace of mind that comes from knowing they are protected against life’s uncertainties. The company’s core values are centered around integrity, customer focus, innovation, and excellence. Types of Insurance Products Offered Ameca Insurance offers a diverse range of insurance products tailored to meet the specific needs of its customers. These products include: Property Insurance: Protects homeowners and businesses against damage or loss to their property due to various perils, including fire, theft, and natural disasters. Liability Insurance: Provides financial protection against legal claims arising from accidents or injuries caused by the insured. Life Insurance: Offers financial security to beneficiaries in the event of the insured’s death, helping to cover expenses such as funeral costs, outstanding debts, and lost income. Health Insurance: Covers medical expenses, including hospitalization, surgery, and medication, providing financial protection against unexpected healthcare costs. Auto Insurance: Protects vehicle owners against financial losses arising from accidents, theft, and other incidents involving their vehicles. Ameca Insurance’s products are designed to provide comprehensive coverage and flexibility, allowing customers to choose the options that best meet their individual needs and budgets. Target Audience and Market Ameca Insurance targets a diverse customer base, focusing on individuals and families seeking comprehensive insurance solutions. This target audience is characterized by specific demographics, needs, and preferences that influence their insurance choices. Demographics of the Target Audience The primary target audience for Ameca Insurance comprises individuals and families across various age groups, income levels, and geographic locations. This diverse group includes: Young adults: This segment represents a significant portion of the target audience, with a growing need for auto insurance as they begin driving and establish their independence. This group is typically tech-savvy and prefers digital interactions for insurance services. Families with children: Families with young children require comprehensive coverage for their vehicles and homes, including liability protection. They prioritize affordability and value-added services like family-friendly discounts and safety features. Seniors: As individuals age, their insurance needs evolve. Seniors require coverage for health, home, and auto insurance, often seeking specialized policies that address their unique requirements. They appreciate personalized customer service and easy-to-understand policy information. Needs and Preferences of the Target Audience The target audience for Ameca Insurance has specific needs and preferences that shape their insurance choices. These include: Affordability: Price is a major factor for most customers, especially younger adults and families with limited budgets. Ameca Insurance aims to offer competitive rates and flexible payment options to meet this need. Convenience: Today’s consumers value convenience in their insurance services. They prefer online platforms for policy management, claims reporting, and customer support. Ameca Insurance provides a user-friendly website and mobile app for seamless interaction. Personalized Service: Customers appreciate personalized attention and tailored insurance solutions. Ameca Insurance offers dedicated agents who provide guidance and support throughout the policy lifecycle. Transparency: Customers seek transparency in insurance pricing and policy terms. Ameca Insurance strives for clear communication and easy-to-understand policy documents. Competitive Landscape Ameca Insurance operates in a highly competitive market with established players like State Farm, Geico, and Progressive. These companies have strong brand recognition, extensive distribution networks, and significant marketing budgets. State Farm: Known for its strong customer service and extensive agent network, State Farm holds a dominant position in the insurance market. Geico: Geico focuses on affordability and digital convenience, offering competitive rates and online policy management. Progressive: Progressive emphasizes innovation and personalization, offering customized insurance solutions and telematics programs. Ameca Insurance differentiates itself by offering a unique combination of affordability, convenience, and personalized service. The company leverages technology to streamline operations and provide a seamless customer experience. By understanding the needs and preferences of its target audience and effectively competing in the market, Ameca Insurance aims to establish a strong presence in the insurance industry. Product and Service Offerings Ameca Insurance offers a comprehensive suite of insurance products designed to meet the diverse needs of its customers. The company’s offerings are characterized by their flexibility, affordability, and commitment to providing exceptional customer service. Auto Insurance Ameca Insurance offers a variety of auto insurance options to meet the specific needs of its customers. These options include: * Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. * Collision Coverage: This coverage helps pay for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. * Comprehensive Coverage: This coverage helps pay for repairs to your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or a natural disaster. * Uninsured/Underinsured Motorist Coverage: This coverage protects you financially if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. * Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers if you are injured in an accident, regardless of who is at fault. Homeowners Insurance Ameca Insurance provides homeowners insurance policies that protect your home and belongings from a range of perils, including: * Fire: This coverage helps pay for repairs or replacement of your home if it is damaged by fire. * Windstorm and Hail: This coverage helps pay for repairs or replacement of your home if it is damaged by windstorms or hail. * Theft: This coverage helps pay for the replacement of your belongings if they are stolen from your home. * Vandalism: This coverage helps pay for repairs or replacement of your home if it is damaged by vandalism. * Liability: This coverage protects you financially if someone is injured on your property or if your property damages someone else’s property. Renters Insurance Ameca Insurance offers renters insurance policies that protect your personal belongings from a range of perils, including: * Fire: This coverage helps pay for the replacement of your belongings if they are damaged by fire. * Theft: This coverage helps pay for the replacement of your belongings if they are stolen from your apartment. * Vandalism: This coverage helps pay for the replacement of your belongings if they are damaged by vandalism. * Liability: This coverage protects you financially if someone is injured in your apartment or if your property damages someone else’s property. Business Insurance … Read more