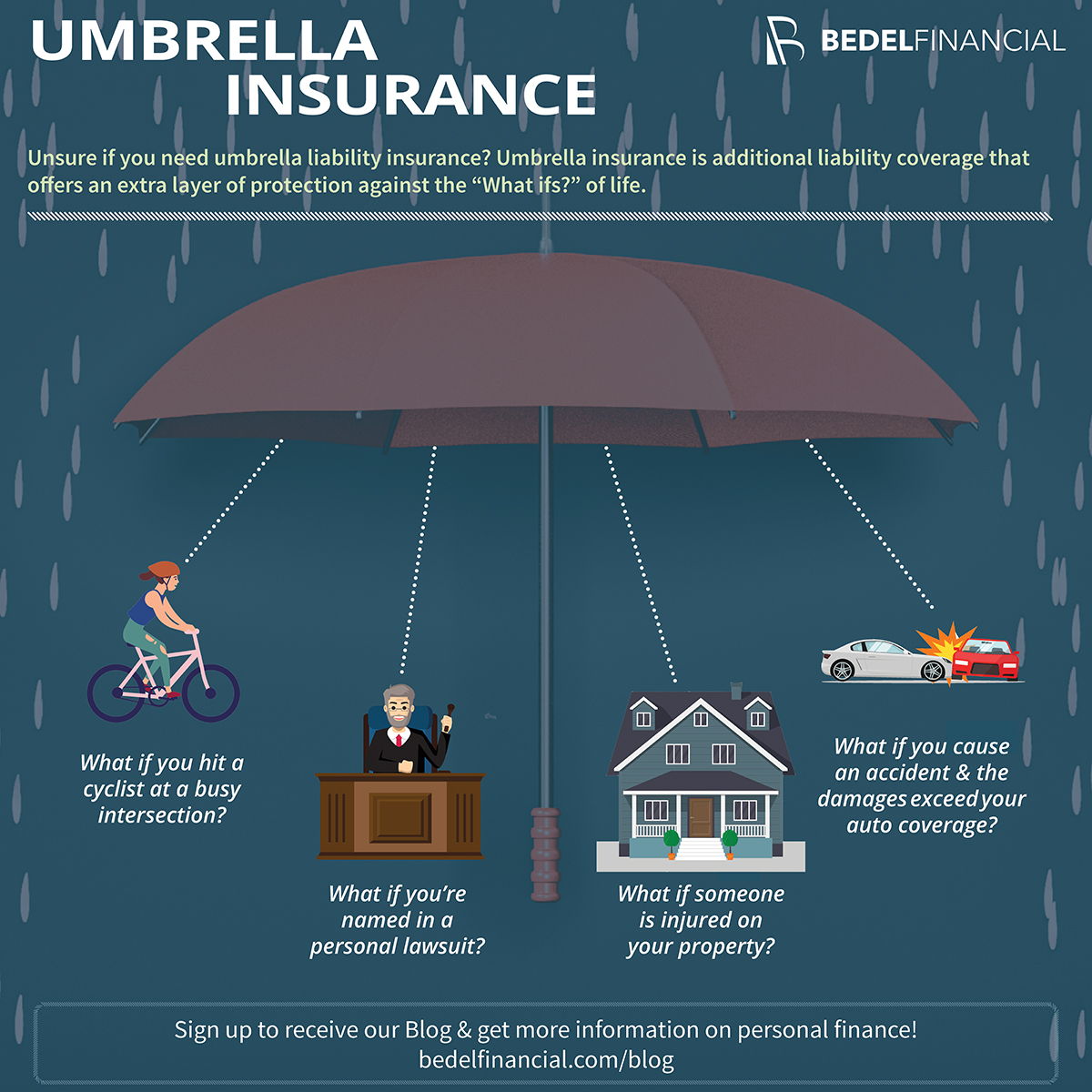

Imagine a scenario where a simple slip and fall on your property results in a hefty lawsuit, potentially jeopardizing your hard-earned savings and assets. This is where umbrella liability insurance steps in as a crucial financial safety net, providing an extra layer of protection against unexpected risks and potential financial ruin. Umbrella liability insurance acts as a supplemental policy, extending your existing liability coverage beyond the limits of your homeowner’s, auto, or other primary insurance policies. It’s designed to safeguard your financial well-being by offering a broader scope of coverage and higher limits, shielding you from catastrophic claims that could otherwise leave you financially vulnerable. What is Umbrella Liability Insurance? Umbrella liability insurance is a type of insurance policy that provides additional coverage above and beyond the limits of your other liability insurance policies, such as homeowners, auto, or renters insurance. It acts as an extra layer of protection, offering financial security in the event of a significant liability claim that exceeds the coverage limits of your underlying policies. Purpose of Umbrella Liability Insurance The primary purpose of umbrella liability insurance is to safeguard your assets and financial well-being in the event of a catastrophic liability claim. It acts as a safety net, offering peace of mind by providing an additional layer of protection that can cover potential costs beyond the limits of your existing insurance policies. When is Umbrella Liability Insurance Typically Needed? Umbrella liability insurance is typically recommended for individuals and families with: Significant assets, such as homes, investments, or retirement savings. High net worth, as they are more susceptible to large liability claims. A history of claims or potential exposure to high-risk activities, such as owning a pool or having a dog. A business or professional practice, as they carry greater liability risks. Examples of Situations Where Umbrella Liability Insurance Could Be Helpful Here are some examples of situations where umbrella liability insurance could prove invaluable: A car accident resulting in serious injuries and significant medical expenses that exceed your auto insurance limits. A slip-and-fall accident on your property, leading to a substantial lawsuit. A defamation lawsuit arising from a social media post or online comment. A product liability claim stemming from a defective product you sold or manufactured. A claim of negligence for an injury sustained during a recreational activity, such as skiing or boating. How Umbrella Liability Insurance Works Umbrella liability insurance acts as an extra layer of protection, extending the coverage of your existing liability policies, such as homeowners, auto, or renters insurance. It provides financial protection in the event of a significant liability claim that exceeds the limits of your underlying policies. Umbrella liability insurance functions as a supplemental layer of coverage, stepping in when the limits of your primary liability policies are exhausted. This means that it kicks in after your primary insurance has paid out its maximum coverage amount. Coverage Limits Umbrella liability insurance policies have coverage limits, which are the maximum amount the insurer will pay for covered claims. These limits are typically expressed in millions of dollars, and they are significantly higher than the limits of standard liability policies. For example, a homeowner’s insurance policy might have a liability limit of $100,000, while an umbrella policy could provide coverage up to $1 million or more. This extra protection can be crucial in situations where a lawsuit or claim exceeds the limits of your primary policies. Factors Determining Cost The cost of umbrella liability insurance is influenced by various factors, including: Underlying Liability Coverage Limits: The higher the limits of your existing liability policies, the lower the cost of umbrella coverage. This is because the umbrella policy is essentially providing additional coverage on top of your existing policies. Coverage Limits: The higher the coverage limits you choose for your umbrella policy, the more expensive it will be. This is because you are purchasing more protection, and the insurer is assuming greater financial risk. Location: The cost of umbrella liability insurance can vary depending on where you live. Some states have higher rates due to factors such as higher lawsuit frequency or the cost of living. Claims History: If you have a history of claims or accidents, your insurance premiums may be higher. Insurance companies assess risk based on your past driving record, claims history, and other factors. Assets: The amount of assets you own, such as a home, investments, or other valuables, can influence the cost of umbrella coverage. Insurance companies consider the potential financial exposure they face if they have to cover a large claim against you. Types of Coverage Under Umbrella Liability Insurance Umbrella liability insurance provides extra protection beyond the limits of your existing liability policies, such as homeowners, auto, or business insurance. It acts as a safety net, offering financial coverage for a wider range of potential claims that could exceed the limits of your primary policies. Umbrella liability insurance typically covers various types of claims, including: Personal Liability Claims Personal umbrella liability insurance provides coverage for a wide range of incidents that could lead to legal liability, protecting your assets in case of a significant claim. This includes: Bodily Injury: This covers injuries caused to another person due to your negligence, such as a car accident or a slip and fall on your property. Property Damage: This covers damage to someone else’s property due to your actions, such as a fire caused by your negligence or a tree falling on your neighbor’s car. Personal Injury: This covers non-physical injuries, such as libel, slander, defamation, or invasion of privacy. Legal Defense Costs: This covers the costs of defending yourself against a lawsuit, even if the claim is ultimately found to be frivolous. Business Liability Claims Business umbrella liability insurance is designed for businesses to provide additional coverage beyond their general liability insurance. This type of coverage can protect businesses from various risks, such as: Product Liability: This covers claims arising from defective products that cause injury or damage to consumers. Professional Liability: This covers claims arising from professional negligence, such as errors or omissions by professionals like doctors, lawyers, or accountants. Directors and Officers Liability: This covers claims against directors and officers for their actions or decisions on behalf of the company. Employment Practices Liability: This covers claims related to employment practices, such as discrimination, wrongful termination, or harassment. Coverage Exclusions and Limitations While umbrella liability insurance provides broad coverage, there are some exclusions and limitations to be aware of. These typically include: Intentional Acts: Umbrella policies usually do not cover claims arising from intentional acts, such as assault or fraud. Business-Related Claims: Personal umbrella policies generally do not cover business-related claims, while business umbrella policies do not cover personal claims. Claims Covered by Other Policies: Umbrella policies typically only cover claims that exceed the limits of your underlying liability policies. Certain Types of Risks: Umbrella policies may exclude coverage for specific types of risks, such as nuclear accidents or environmental pollution. Benefits of Umbrella Liability Insurance Umbrella liability insurance provides an additional layer of financial protection beyond what is offered by standard liability policies, such as homeowners, auto, or renters insurance. It acts as a safety net, safeguarding your assets and personal finances against unexpected lawsuits and claims. This type of insurance can offer peace of mind and financial security in situations where standard policies may not be enough. … Read more