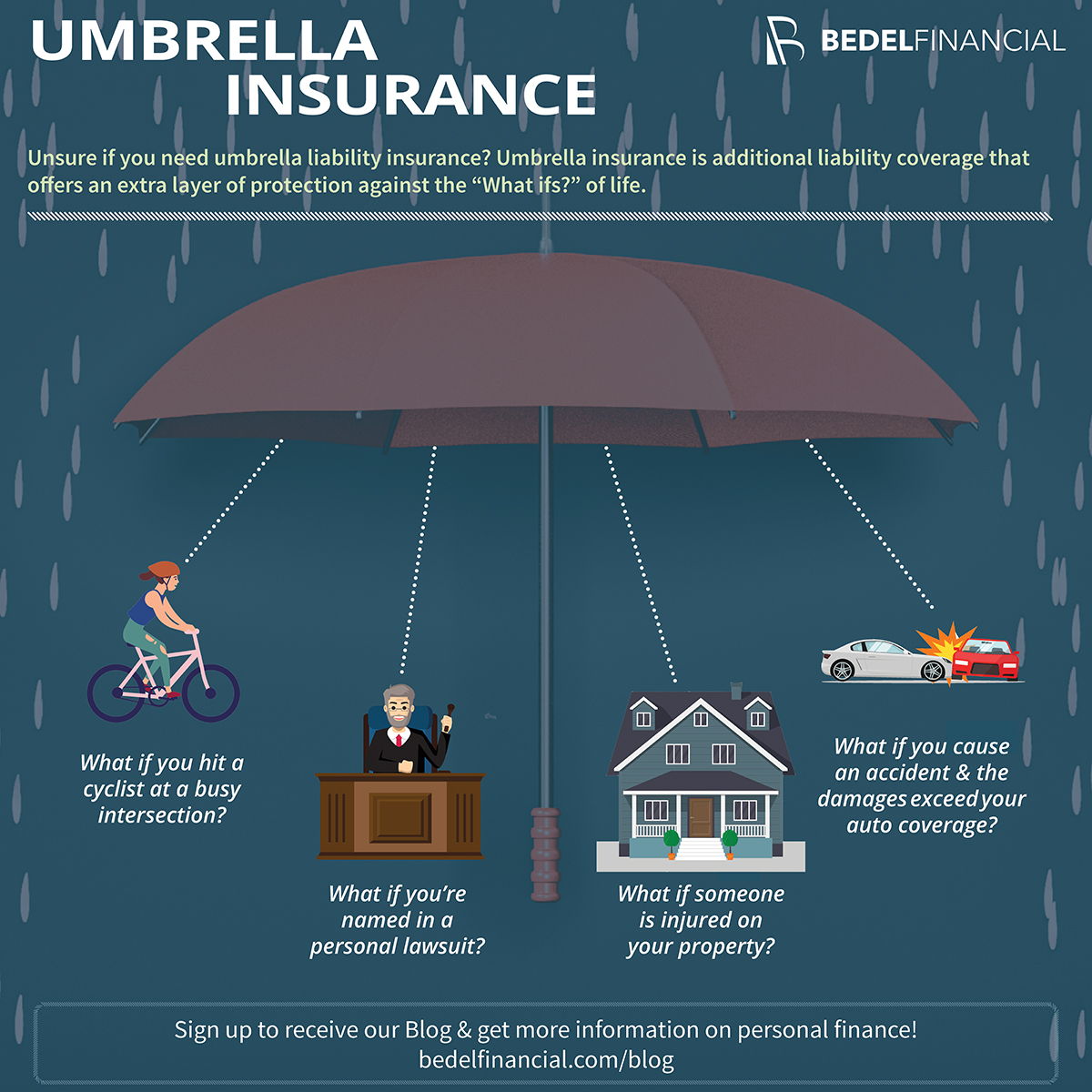

In an era marked by increasing economic uncertainty and evolving risk profiles, the role of insurance has become more critical than ever. Torres Insurance stands as a beacon of stability and security, offering a comprehensive suite of products and services designed to safeguard individuals and businesses against unforeseen events. With a legacy built on a deep understanding of the insurance landscape and a commitment to customer-centric solutions, Torres Insurance has emerged as a trusted partner for navigating the complexities of risk. This exploration delves into the history, offerings, and values that define Torres Insurance, examining its impact on the market and its vision for the future. From the core principles that guide its operations to the innovative strategies employed to meet the evolving needs of its clients, this analysis provides a comprehensive overview of Torres Insurance’s position within the dynamic world of risk management. Torres Insurance Overview Torres Insurance is a reputable insurance provider with a rich history of serving the needs of its diverse clientele. Founded in [Year], the company has steadily grown to become a trusted name in the insurance industry, known for its commitment to providing comprehensive and personalized insurance solutions. Key Services Offered Torres Insurance offers a wide range of insurance products and services designed to cater to the diverse needs of its clients. These services include: Property and Casualty Insurance: This includes coverage for homes, businesses, automobiles, and other assets against various risks, such as fire, theft, natural disasters, and accidents. Life Insurance: Torres Insurance offers various life insurance policies, including term life, whole life, and universal life, designed to provide financial security for families and loved ones in the event of an unexpected death. Health Insurance: The company provides a variety of health insurance plans, including individual and family health insurance, Medicare supplements, and dental and vision insurance, to help clients manage their healthcare costs and ensure access to quality medical care. Business Insurance: Torres Insurance offers a comprehensive suite of business insurance products, including general liability, workers’ compensation, professional liability, and property insurance, to protect businesses from financial losses due to various risks. Financial Planning and Retirement Planning: Torres Insurance also provides financial planning and retirement planning services, helping clients achieve their financial goals and secure their financial future. Target Market and Customer Base Torres Insurance targets a broad customer base, serving individuals, families, and businesses across various demographics and income levels. The company understands the unique needs of its diverse clientele and tailors its products and services to meet those needs effectively. Torres Insurance’s target market includes: Homeowners: The company offers comprehensive home insurance policies to protect homeowners against various risks, including fire, theft, natural disasters, and liability claims. Auto Owners: Torres Insurance provides auto insurance policies that cover liability, collision, comprehensive, and other coverage options to protect car owners from financial losses in the event of an accident. Businesses: Torres Insurance offers a comprehensive suite of business insurance products designed to protect businesses from financial losses due to various risks, including general liability, workers’ compensation, professional liability, and property insurance. Individuals and Families: Torres Insurance provides life insurance, health insurance, and other insurance products to individuals and families, offering financial security and peace of mind. Insurance Products and Services Torres Insurance offers a comprehensive range of insurance products designed to meet the diverse needs of individuals and businesses. These policies provide financial protection against various risks, ensuring peace of mind and security for our clients. Types of Insurance Policies Torres Insurance offers a wide array of insurance products, each designed to address specific needs and risks. Here are some of the key types of insurance policies we provide: Property Insurance: This type of insurance protects homeowners and businesses against financial losses resulting from damage to their property due to perils such as fire, theft, vandalism, and natural disasters. It covers both the structure and contents of the property. Liability Insurance: This policy provides financial protection against claims arising from bodily injury or property damage caused by the insured. It is crucial for individuals and businesses to mitigate potential legal and financial consequences of accidents or negligence. Auto Insurance: This policy covers financial losses resulting from accidents involving the insured vehicle. It typically includes coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection. Life Insurance: This policy provides financial protection to beneficiaries upon the death of the insured. It offers a lump-sum payment that can be used to cover funeral expenses, debts, or other financial needs. Health Insurance: This policy provides financial protection against medical expenses incurred due to illness or injury. It covers a range of healthcare services, including doctor visits, hospital stays, and prescription drugs. Business Insurance: This comprehensive suite of insurance products is tailored to the specific needs of businesses. It includes policies such as general liability, workers’ compensation, property insurance, and professional liability insurance. Coverage and Benefits of Insurance Products Each insurance policy offered by Torres Insurance provides specific coverage and benefits designed to address the unique needs of our clients. Here are some key aspects of coverage and benefits: Property Insurance: This policy typically covers the cost of repairs or replacement of damaged property, as well as additional living expenses incurred during the restoration process. Liability Insurance: This policy provides financial protection against lawsuits, legal fees, and settlements arising from accidents or negligence. It can help mitigate the financial burden associated with legal disputes. Auto Insurance: This policy covers medical expenses, property damage, and legal fees arising from accidents. It also offers financial protection against losses caused by uninsured or underinsured motorists. Life Insurance: This policy provides a lump-sum death benefit to beneficiaries, ensuring financial security for their future. It can be used to cover funeral expenses, debts, or other financial needs. Health Insurance: This policy covers medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care. It can help mitigate the financial burden of healthcare costs. Business Insurance: This policy provides financial protection against various risks faced by businesses, such as lawsuits, property damage, employee injuries, and professional negligence. Examples of Specific Insurance Policies Torres Insurance offers a variety of specific insurance policies tailored to meet the diverse needs of our clients. Here are a few examples: Homeowners Insurance: This policy provides coverage for damage to the insured’s home and belongings, as well as liability protection for accidents occurring on the property. Renters Insurance: This policy protects renters against financial losses due to damage to their belongings, liability claims, and additional living expenses. Commercial Property Insurance: This policy provides coverage for damage to commercial buildings and business property, as well as liability protection for accidents occurring on the premises. Workers’ Compensation Insurance: This policy provides financial protection to employees who are injured or become ill while on the job. It covers medical expenses, lost wages, and rehabilitation costs. Professional Liability Insurance (E&O): This policy protects professionals, such as doctors, lawyers, and accountants, against claims of negligence or errors in their professional services. Customer Experience and Service At Torres Insurance, we prioritize building strong and lasting relationships with our customers. We believe that providing exceptional customer service is not just a business strategy but a fundamental principle that guides our every interaction. Our customer service philosophy is rooted in the belief that every interaction is an opportunity to build trust, demonstrate empathy, and provide personalized solutions. We strive to make the insurance experience as seamless and stress-free as possible, empowering our customers to navigate the complexities of insurance with confidence. Customer Testimonials and Case Studies The positive feedback we receive from our customers is a testament to our commitment to exceptional service. Here are a few examples of how we have helped our clients: A young family in New York City was facing a challenging situation after a fire damaged their apartment. They were overwhelmed with the process of filing claims and dealing with the aftermath. Torres Insurance assigned a dedicated claims adjuster who guided them through every step, ensuring they received the necessary support and compensation to rebuild their lives. A small business owner in California was struggling to understand the complexities of commercial insurance. Our experienced agents provided clear and concise explanations of the various coverage options, tailoring a policy that met the specific needs of their business. The owner expressed their appreciation for the personalized attention and expertise they received. Customer Support Channels We offer multiple channels for customers to reach out to us and receive assistance: Phone: Our dedicated customer service team is available 24/7 to answer questions, provide support, and address any concerns. Email: Customers can send inquiries or feedback to our email address, which is monitored and responded to promptly. Online Portal: Our secure online portal allows customers to access their policy information, make payments, file claims, and manage their account conveniently. … Read more