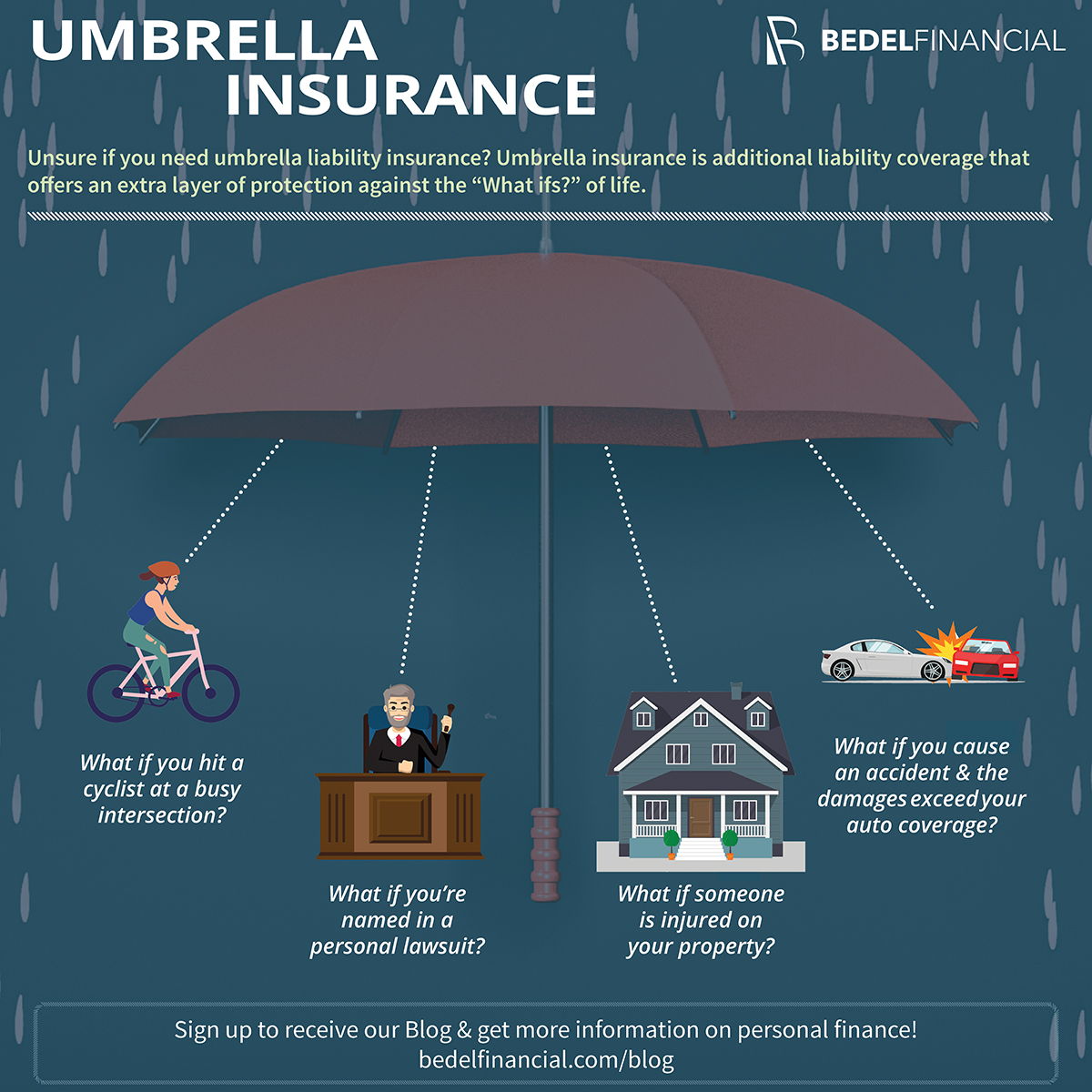

Imagine a scenario where a simple slip and fall on your property results in a hefty lawsuit, potentially jeopardizing your hard-earned savings and assets. This is where umbrella liability insurance steps in as a crucial financial safety net, providing an extra layer of protection against unexpected risks and potential financial ruin.

Umbrella liability insurance acts as a supplemental policy, extending your existing liability coverage beyond the limits of your homeowner’s, auto, or other primary insurance policies. It’s designed to safeguard your financial well-being by offering a broader scope of coverage and higher limits, shielding you from catastrophic claims that could otherwise leave you financially vulnerable.

What is Umbrella Liability Insurance?

Umbrella liability insurance is a type of insurance policy that provides additional coverage above and beyond the limits of your other liability insurance policies, such as homeowners, auto, or renters insurance. It acts as an extra layer of protection, offering financial security in the event of a significant liability claim that exceeds the coverage limits of your underlying policies.

Purpose of Umbrella Liability Insurance

The primary purpose of umbrella liability insurance is to safeguard your assets and financial well-being in the event of a catastrophic liability claim. It acts as a safety net, offering peace of mind by providing an additional layer of protection that can cover potential costs beyond the limits of your existing insurance policies.

When is Umbrella Liability Insurance Typically Needed?

Umbrella liability insurance is typically recommended for individuals and families with:

- Significant assets, such as homes, investments, or retirement savings.

- High net worth, as they are more susceptible to large liability claims.

- A history of claims or potential exposure to high-risk activities, such as owning a pool or having a dog.

- A business or professional practice, as they carry greater liability risks.

Examples of Situations Where Umbrella Liability Insurance Could Be Helpful

Here are some examples of situations where umbrella liability insurance could prove invaluable:

- A car accident resulting in serious injuries and significant medical expenses that exceed your auto insurance limits.

- A slip-and-fall accident on your property, leading to a substantial lawsuit.

- A defamation lawsuit arising from a social media post or online comment.

- A product liability claim stemming from a defective product you sold or manufactured.

- A claim of negligence for an injury sustained during a recreational activity, such as skiing or boating.

How Umbrella Liability Insurance Works

Umbrella liability insurance acts as an extra layer of protection, extending the coverage of your existing liability policies, such as homeowners, auto, or renters insurance. It provides financial protection in the event of a significant liability claim that exceeds the limits of your underlying policies.

Umbrella liability insurance functions as a supplemental layer of coverage, stepping in when the limits of your primary liability policies are exhausted. This means that it kicks in after your primary insurance has paid out its maximum coverage amount.

Coverage Limits

Umbrella liability insurance policies have coverage limits, which are the maximum amount the insurer will pay for covered claims. These limits are typically expressed in millions of dollars, and they are significantly higher than the limits of standard liability policies.

For example, a homeowner’s insurance policy might have a liability limit of $100,000, while an umbrella policy could provide coverage up to $1 million or more. This extra protection can be crucial in situations where a lawsuit or claim exceeds the limits of your primary policies.

Factors Determining Cost

The cost of umbrella liability insurance is influenced by various factors, including:

- Underlying Liability Coverage Limits: The higher the limits of your existing liability policies, the lower the cost of umbrella coverage. This is because the umbrella policy is essentially providing additional coverage on top of your existing policies.

- Coverage Limits: The higher the coverage limits you choose for your umbrella policy, the more expensive it will be. This is because you are purchasing more protection, and the insurer is assuming greater financial risk.

- Location: The cost of umbrella liability insurance can vary depending on where you live. Some states have higher rates due to factors such as higher lawsuit frequency or the cost of living.

- Claims History: If you have a history of claims or accidents, your insurance premiums may be higher. Insurance companies assess risk based on your past driving record, claims history, and other factors.

- Assets: The amount of assets you own, such as a home, investments, or other valuables, can influence the cost of umbrella coverage. Insurance companies consider the potential financial exposure they face if they have to cover a large claim against you.

Types of Coverage Under Umbrella Liability Insurance

Umbrella liability insurance provides extra protection beyond the limits of your existing liability policies, such as homeowners, auto, or business insurance. It acts as a safety net, offering financial coverage for a wider range of potential claims that could exceed the limits of your primary policies.

Umbrella liability insurance typically covers various types of claims, including:

Personal Liability Claims

Personal umbrella liability insurance provides coverage for a wide range of incidents that could lead to legal liability, protecting your assets in case of a significant claim. This includes:

- Bodily Injury: This covers injuries caused to another person due to your negligence, such as a car accident or a slip and fall on your property.

- Property Damage: This covers damage to someone else’s property due to your actions, such as a fire caused by your negligence or a tree falling on your neighbor’s car.

- Personal Injury: This covers non-physical injuries, such as libel, slander, defamation, or invasion of privacy.

- Legal Defense Costs: This covers the costs of defending yourself against a lawsuit, even if the claim is ultimately found to be frivolous.

Business Liability Claims

Business umbrella liability insurance is designed for businesses to provide additional coverage beyond their general liability insurance. This type of coverage can protect businesses from various risks, such as:

- Product Liability: This covers claims arising from defective products that cause injury or damage to consumers.

- Professional Liability: This covers claims arising from professional negligence, such as errors or omissions by professionals like doctors, lawyers, or accountants.

- Directors and Officers Liability: This covers claims against directors and officers for their actions or decisions on behalf of the company.

- Employment Practices Liability: This covers claims related to employment practices, such as discrimination, wrongful termination, or harassment.

Coverage Exclusions and Limitations

While umbrella liability insurance provides broad coverage, there are some exclusions and limitations to be aware of. These typically include:

- Intentional Acts: Umbrella policies usually do not cover claims arising from intentional acts, such as assault or fraud.

- Business-Related Claims: Personal umbrella policies generally do not cover business-related claims, while business umbrella policies do not cover personal claims.

- Claims Covered by Other Policies: Umbrella policies typically only cover claims that exceed the limits of your underlying liability policies.

- Certain Types of Risks: Umbrella policies may exclude coverage for specific types of risks, such as nuclear accidents or environmental pollution.

Benefits of Umbrella Liability Insurance

Umbrella liability insurance provides an additional layer of financial protection beyond what is offered by standard liability policies, such as homeowners, auto, or renters insurance. It acts as a safety net, safeguarding your assets and personal finances against unexpected lawsuits and claims. This type of insurance can offer peace of mind and financial security in situations where standard policies may not be enough.

Financial Protection Beyond Standard Policies

Umbrella liability insurance provides an extra layer of coverage that extends beyond the limits of your existing policies. It kicks in when the liability limits of your primary insurance policies are exhausted, providing additional coverage for claims and lawsuits. For instance, if you are involved in an accident that results in a claim exceeding the liability limits of your auto insurance, your umbrella policy can help cover the remaining costs.

Peace of Mind Against Unexpected Lawsuits and Claims

Unexpected lawsuits and claims can arise from various situations, such as accidents, property damage, or even libel. Umbrella liability insurance offers peace of mind by providing coverage for these unforeseen events, helping you navigate legal and financial challenges. This type of insurance can protect you from significant financial losses that could arise from lawsuits or claims exceeding your primary policy limits.

Safeguarding Assets and Protecting Personal Finances

Umbrella liability insurance can safeguard your assets and protect your personal finances by providing coverage for a wide range of liabilities. This coverage can include legal defense costs, settlements, judgments, and other expenses associated with lawsuits or claims. In situations where a lawsuit or claim threatens your financial stability, umbrella liability insurance can act as a safety net, helping you mitigate the financial impact.

When You Might Need Umbrella Liability Insurance

Umbrella liability insurance is a valuable addition to your overall insurance strategy when you have significant assets to protect. It provides an extra layer of financial protection in case you are found liable for a substantial claim exceeding your underlying liability coverage. Several scenarios can indicate the need for umbrella liability insurance, particularly when you face a high risk of liability.

Individuals with High-Risk Activities

Umbrella liability insurance is highly recommended for individuals engaging in activities with a higher potential for liability, such as:

- Owning a swimming pool: Pools can pose a significant safety risk, especially for children. Accidents can result in serious injuries, leading to substantial liability claims. Umbrella liability insurance can provide additional coverage beyond your homeowner’s insurance policy.

- Owning dangerous pets: Certain breeds of dogs, such as Rottweilers or Pit Bulls, are considered more prone to aggressive behavior. If your pet bites someone, causing injury, you could be held liable for substantial medical expenses and other damages. Umbrella liability insurance can help cover these costs.

- Hosting large gatherings: If you regularly host large parties or events, you may be at risk of liability if an accident occurs. For example, if someone is injured while attending a party at your home, you could be held liable. Umbrella liability insurance provides additional coverage for such situations.

The Claims Process with Umbrella Liability Insurance

Filing a claim under an umbrella liability policy typically involves several steps. The process starts with reporting the incident to your insurance company and ends with the insurance company settling the claim.

The Role of the Insurance Company in Handling Claims and Settlements

The insurance company plays a crucial role in managing the claims process. The insurer will investigate the claim to determine its validity and the extent of coverage. They will also negotiate with the claimant and their legal representatives to reach a settlement.

Steps Involved in Filing a Claim

- Report the Incident: The first step is to notify your insurance company about the incident as soon as possible. This allows the insurer to start investigating the claim promptly.

- Provide Documentation: You will need to provide the insurance company with relevant documentation, such as police reports, medical records, and witness statements.

- Investigate the Claim: The insurance company will investigate the claim to determine its validity and the extent of coverage. This may involve interviewing witnesses, reviewing evidence, and consulting with experts.

- Negotiate a Settlement: Once the investigation is complete, the insurance company will negotiate a settlement with the claimant. This process may involve legal representatives from both sides.

- Pay the Settlement: If a settlement is reached, the insurance company will pay the claimant the agreed-upon amount.

The Importance of Keeping Accurate Records and Documentation

Maintaining accurate records and documentation is crucial for a smooth claims process. This includes:

- Policy Documents: Keep your umbrella liability policy documents readily available. This will help you understand your coverage and the claims process.

- Incident Details: Record the date, time, and location of the incident. Include details about the parties involved, any witnesses, and the nature of the incident.

- Communication with the Insurance Company: Keep a record of all communication with your insurance company, including dates, times, and the content of conversations. This will help you track the progress of your claim.

- Supporting Documents: Gather any supporting documentation, such as medical bills, repair estimates, and police reports. These documents will help support your claim and ensure a fair settlement.

Choosing the Right Umbrella Liability Insurance

Selecting the right umbrella liability insurance policy involves careful consideration of various factors to ensure you have adequate coverage for your specific needs and circumstances. It’s essential to understand the different aspects of umbrella liability insurance and how they apply to your individual situation.

Factors to Consider When Choosing an Umbrella Liability Policy

Understanding the factors that influence the selection of an umbrella liability policy is crucial. Here are some key considerations:

- Your Assets: The amount of coverage you need depends on your assets, such as your home, investments, and savings. Umbrella policies protect these assets from potential lawsuits. Consider the value of your assets and determine the appropriate coverage level.

- Your Lifestyle: Your lifestyle plays a role in determining your risk exposure. Activities like owning a pool, owning a dog, or driving frequently can increase your liability risk. Higher risk activities may warrant a higher coverage limit.

- Your Personal Circumstances: Factors like your profession, family size, and location can influence your liability risk. For instance, a high-profile profession or living in a densely populated area may increase your exposure to lawsuits.

- Your Existing Insurance Policies: Umbrella policies typically cover liabilities exceeding your underlying home, auto, and other liability insurance policies. It’s essential to understand the limits of your existing policies to determine the necessary coverage gap.

- Your Budget: Umbrella liability insurance premiums vary based on factors like coverage limits, deductibles, and risk assessment. Consider your budget and choose a policy that provides sufficient coverage without putting an undue strain on your finances.

Selecting a Reputable Insurance Company

Choosing a reputable insurance company with a strong track record is crucial for peace of mind. Here are some factors to consider:

- Financial Stability: Look for a company with a strong financial rating from agencies like A.M. Best or Standard & Poor’s. A stable company is more likely to be able to pay claims when needed.

- Claims Handling: Research the company’s reputation for fair and efficient claims handling. Look for reviews and testimonials from previous customers.

- Customer Service: Choose a company known for its responsive and helpful customer service. Consider factors like availability, accessibility, and communication channels.

- Policy Transparency: Ensure the policy language is clear and understandable. Review the policy carefully to understand the coverage details, exclusions, and limitations.

Comparing Quotes and Coverage Options

Shopping around for quotes and comparing coverage options is essential to find the best value for your needs. Here are some tips:

- Get Multiple Quotes: Contact several insurance companies to obtain quotes for similar coverage levels. This allows you to compare prices and coverage details.

- Compare Coverage Limits: Pay attention to the coverage limits offered by different companies. Ensure the policy provides adequate protection for your assets and liabilities.

- Review Deductibles: Higher deductibles typically result in lower premiums. Consider your financial situation and risk tolerance when choosing a deductible.

- Consider Additional Coverage Options: Some companies offer additional coverage options, such as legal defense coverage or coverage for certain types of claims. Evaluate these options based on your individual needs.

Understanding the Costs of Umbrella Liability Insurance

The cost of umbrella liability insurance is influenced by various factors, including your individual risk profile, the coverage limits you choose, and the insurer you select. Understanding these factors can help you determine the cost of umbrella liability insurance and potentially find ways to reduce your premiums.

Factors Influencing the Cost of Umbrella Liability Insurance

Several factors influence the cost of umbrella liability insurance. These factors are considered by insurers when assessing your risk profile and determining your premium.

- Your Existing Liability Coverage: The amount of liability coverage you have through your homeowners, renters, or auto insurance policies significantly affects the cost of umbrella insurance. Higher existing liability limits generally result in lower umbrella insurance premiums, as you are already covered for a larger portion of potential liability.

- Your Personal Risk Profile: Factors such as your driving history, claims history, and the types of activities you engage in can influence your risk profile. For instance, individuals with a history of accidents or claims may face higher premiums compared to those with clean records.

- Your Location: Your geographic location can impact the cost of umbrella insurance. Areas with higher rates of accidents or lawsuits may have higher premiums due to increased risk.

- Your Assets: The value of your assets, such as your home, investments, and other valuables, can influence the cost of umbrella insurance. Insurers may consider your assets when determining your risk, as they represent potential targets for lawsuits.

- Your Lifestyle: Your lifestyle can also affect your premium. For example, if you own a boat, engage in high-risk activities like skiing or skydiving, or have a large number of guests at your home, you may face higher premiums.

Relationship Between Coverage Limits and Premium Costs

The coverage limits you choose for your umbrella liability insurance directly impact the cost of your premiums. Higher coverage limits provide greater protection against significant liability claims but come with higher premiums. Conversely, lower coverage limits may result in lower premiums but offer less protection.

Example: A policy with a $1 million coverage limit will generally cost more than a policy with a $500,000 coverage limit. However, the higher coverage limit provides greater financial protection in case of a major lawsuit.

Tips for Potentially Reducing Premium Costs

While several factors influence the cost of umbrella liability insurance, you can take steps to potentially reduce your premiums.

- Increase Your Existing Liability Limits: By increasing the liability limits on your homeowners, renters, or auto insurance policies, you can often reduce your umbrella insurance premiums. This is because you are already covered for a larger portion of potential liability, reducing the insurer’s risk.

- Improve Your Driving Record: Maintaining a clean driving record is crucial for reducing insurance costs. Avoid traffic violations and accidents to demonstrate responsible driving behavior.

- Bundle Your Insurance: Bundling your homeowners, renters, auto, and umbrella insurance policies with the same insurer can often lead to discounts. This shows the insurer your loyalty and can reduce your overall premiums.

- Shop Around: Comparing quotes from multiple insurers can help you find the best rates for umbrella liability insurance. Consider factors such as coverage limits, deductibles, and customer service when making your decision.

Umbrella Liability Insurance vs. Other Liability Coverage

Umbrella liability insurance is a crucial layer of protection for individuals and families, but it’s important to understand how it complements and differs from other liability coverage options. Understanding these distinctions can help you make informed decisions about your insurance needs.

Comparison with Other Liability Coverage

Umbrella liability insurance provides broader coverage than traditional liability insurance policies like homeowners, renters, auto, and personal liability insurance. It acts as a safety net, offering additional coverage when the limits of your primary policies are exhausted.

- Homeowners and Renters Insurance: These policies cover liability for accidents that occur on your property, but their limits may not be sufficient for substantial claims. Umbrella insurance can provide excess coverage above these limits.

- Auto Insurance: Auto insurance covers liability for accidents involving your vehicle, but its limits may be insufficient for serious injuries or property damage. Umbrella insurance can provide excess coverage to cover the difference.

- Personal Liability Insurance: This coverage protects you from liability for accidents or injuries that occur outside your home or while driving. Umbrella insurance can offer additional coverage beyond the limits of personal liability insurance.

Advantages and Disadvantages of Umbrella Liability Insurance

- Advantages:

- Higher Limits: Umbrella insurance offers significantly higher coverage limits than most primary policies, providing greater protection for substantial claims.

- Broader Coverage: Umbrella insurance covers a wider range of liabilities, including personal injury, property damage, and legal defense costs, extending beyond the scope of primary policies.

- Peace of Mind: Knowing you have substantial coverage can provide peace of mind, protecting you from financial ruin due to unexpected liability claims.

- Disadvantages:

- Additional Cost: Umbrella insurance is an additional expense, requiring a separate premium payment.

- Potential for Deductibles: While umbrella insurance offers high limits, it may have a deductible that needs to be paid before coverage kicks in.

Complementing Other Liability Coverage

Umbrella liability insurance works in conjunction with your primary liability policies, acting as an additional layer of protection. It provides excess coverage above the limits of your homeowners, renters, auto, and personal liability insurance.

For example, if you have a $100,000 liability limit on your homeowners insurance and a $500,000 liability limit on your auto insurance, but a claim exceeds those limits, your umbrella policy could provide additional coverage up to its policy limit.

Umbrella liability insurance helps ensure comprehensive protection, safeguarding you from substantial financial losses due to unexpected liability claims. It acts as a crucial safety net, offering peace of mind and financial security.

Umbrella Liability Insurance and Legal Protection

Umbrella liability insurance can provide crucial legal protection in the event of a claim that exceeds the limits of your underlying insurance policies. This type of insurance acts as a safety net, offering an additional layer of coverage that can shield you from substantial financial losses and legal complications.

Legal Representation and Defense

In the event of a claim, your umbrella liability insurance policy can cover the costs associated with legal representation and defense. This coverage is essential because legal fees can quickly escalate, particularly in complex cases.

- Attorney Fees: Umbrella policies typically cover the fees charged by attorneys hired to represent you in legal proceedings. This can include fees for consultations, depositions, court appearances, and other legal services.

- Court Costs: Court costs, such as filing fees, service fees, and other expenses related to litigation, are often covered by umbrella policies.

- Expert Witness Fees: If your case requires expert testimony, the policy can cover the fees charged by experts, such as medical professionals, engineers, or financial analysts.

Coverage for Legal Expenses

Umbrella liability insurance policies can also provide coverage for various legal expenses incurred during a claim.

- Settlement Negotiations: Umbrella policies can cover the costs associated with negotiating a settlement with the claimant, including the fees of mediators or arbitrators.

- Judgment Costs: If you are found liable in a lawsuit, the policy can cover the amount of the judgment, including any interest or penalties.

- Bond Premiums: In some cases, you may be required to post a bond to secure a judgment or appeal. Umbrella policies can cover the cost of these bond premiums.

Conclusion: The Importance of Umbrella Liability Insurance

Umbrella liability insurance is an essential component of a comprehensive financial strategy, offering valuable protection against unexpected risks. It extends coverage beyond the limits of your existing policies, providing an additional layer of security in the event of a significant liability claim.

The Value of Comprehensive Protection

The potential for unexpected liability claims is ever-present. A single accident, a slip-and-fall incident, or a lawsuit related to your business can quickly exceed the limits of your standard liability insurance. Umbrella liability insurance acts as a safety net, ensuring you have the financial resources to cover these unforeseen expenses.

Proactive Risk Management

Umbrella liability insurance is not just about protecting your assets; it’s about proactively managing your risk exposure. By securing this coverage, you demonstrate a commitment to financial responsibility and a proactive approach to potential liabilities. This can be particularly important for individuals and businesses that face higher risks due to their profession, activities, or assets.

Conclusive Thoughts

In a world filled with uncertainties, securing comprehensive financial protection is paramount. Umbrella liability insurance empowers individuals and businesses to navigate potential risks with greater confidence, knowing that their assets and financial future are safeguarded against unexpected claims. By extending your existing coverage and providing an additional layer of security, umbrella liability insurance serves as a proactive measure to mitigate financial risks and ensure peace of mind.